The West Texas Intermediate Crude Oil market rallied towards the top of the short-term range on Friday, but gave back gains, mainly due to a lot of people covering heading into the weekend. I would not be overly concerned about the selling due to the fact that the market had been so skittish from the last couple of weeks that it would be difficult to imagine that we would simply take off to the upside.

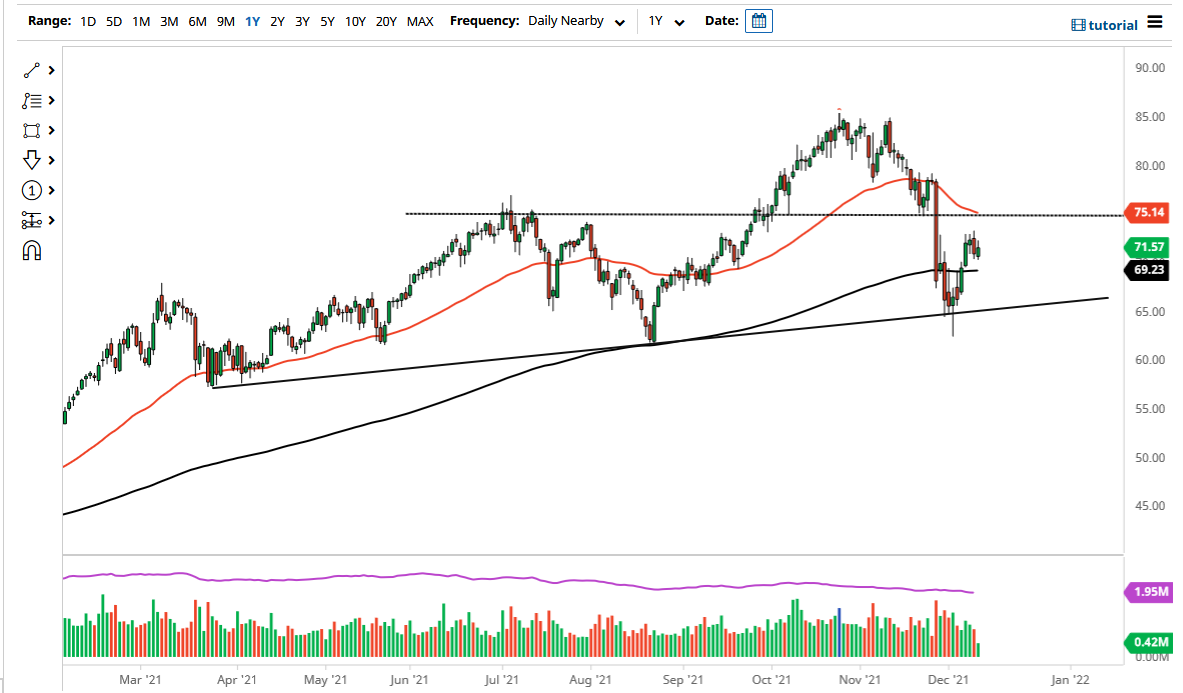

That being said, the market breaking above the $73.25 level would be a very bullish sign, as it could open up the move towards the $75 level. The $75 level also has the 50 day EMA sitting just above it, so I do think that there is a certain amount of significant resistance just waiting to happen there. If we can break above that level, then the market is likely to go looking towards the top of the massive selloff candlestick from a couple of weeks ago when the world lost its mind based upon the omicron headlines. Taking out that candlestick opens up the possibility of a move towards the $80 level, and then possibly even higher than that.

The crude oil market of course will be moving right along with the idea of recovery, due to the fact that although the market has been sold off drastically, there is the 200 day EMA sitting underneath that could come into the picture. The 200 day EMA a lonisger-term technical indicator that a lot of people pay close attention to, so I would not be surprised at all to see a bounce from that region. After that, we have a nice uptrend line that comes into the picture as well.

Keep an eye on the US dollar, because it can also have its influence as well. The US dollar tends run counter to the crude oil market, but that does not necessarily have to be the case. I do think that we will probably see a lot of volatility and choppiness to say the least. However, this is a market that has been quite stable over the last three days, so that is a very good sign. After all, you need to stabilize before you turn around and recover after a move like that.