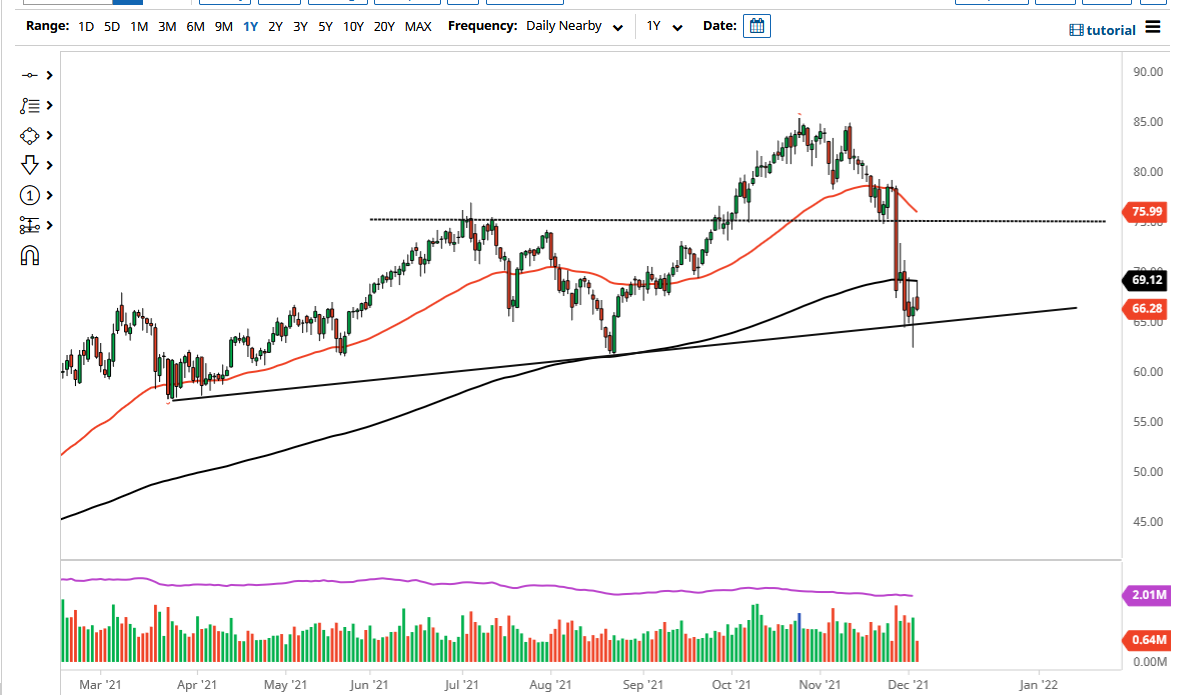

The West Texas Intermediate Crude Oil market initially rallied on Friday, reaching as high as $69.12 before turning around. It is also worth noting that the 200-day EMA sits there as well, and there was the non-farm payroll announcement that was much weaker than anticipated. Because of this, we did see quite a bit of downward pressure after the initial push higher, in what had been looking very much like a nice recovery.

It is also worth noting that the Thursday candlestick was a hammer, so at this point in time it looks like the market is trying to figure out which direction it wants to go. The Wednesday candlestick was an inverted hammer, so all of this tells me one thing rather clearly, which is that we are a bit confused. We are clearly oversold, so the very least we need to kill some time before we start selling off again. Because of this, I think we will probably continue to see a lot of noisy behavior. That being said, if we can break above the 200-day EMA on a daily close, then I think oil will continue to recover. On the other hand, if we break down below the hammer from the Thursday candlestick, that means that the crude oil market will probably go looking towards the $60 level.

Crude oil is down roughly 20% at this point, so one would think that it is only a matter of time before value hunters come back in. A lot of what we have seen has been exacerbated by the omicron variant causing concern about travel, and several countries have started throwing up bans on international travel. That has a massive effect on the oil market, but at this point one would have to think that most of that has been priced in. OPEC decided to go ahead and produce those extra 400,000 barrels a month going forward in January, but they left the meeting marked “open”, suggesting that they will turn things right back around if they have to and have the ability to do so rather quickly. I believe that the next couple of days will give us a bit of a “heads up” as to where we are going longer term, with 75 being a likely target by bullish traders, and $60 be in a likely target by parish traders.