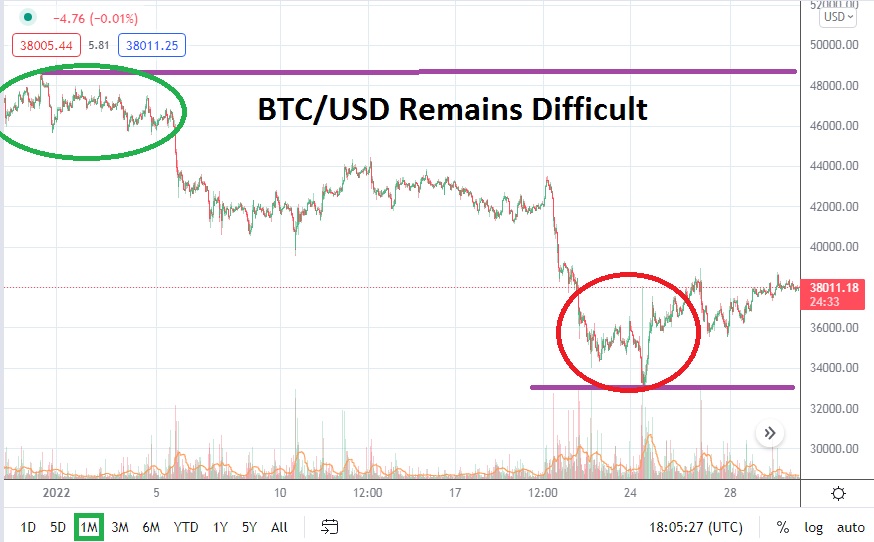

BTC/USD remains under 40,000.00 USD as of this writing; in fact, it is hovering near the 38,000 value as speculators of the world’s biggest cryptocurrency remains must see theatre. BTC/USD traded near its January highs on the 1st and 2nd as it traversed slightly below the 48,000.00 juncture. It has slid downward since then, essentially extending its bearish trend which began the second week of November 2021. At its peak on 9th and 10th of November, Bitcoin traded near the 68,750.00 mark. If the math is done, BTC/USD has lost more than 38,000.00 in less than 3 months of trading.

The bearish trajectory touched a low on the 24th of January when BTC/USD hit a mark of nearly 33,000.00. On the 20th of January, BTC/USD was trading at approximately 43,000.00 when the carnage downwards turned extremely violent. The ability of Bitcoin to climb from its low nearly one week ago is roughly a 5,000.00 USD gain.Traders who survived the rollercoaster down and had money remaining to trade, and decided to attempt buying positions may have potentially made a nice profit.

The past week, month, and long history of Bitcoin often proves that volatility is not only a part of the dynamics, but also an attractive feature. While many bullish optimists continue to be proponents of Bitcoin, traders can find opportunities to speculate on its direction and produce quick hitting results. However, the past week alone from BTC/USD highlights the need for constant risk management, including the use of conservative leverage.

While the gains made in BTC/USD after its fall last week, which tested values last seen in late July 2021 have been solid, Bitcoin remains within sight of dangerous support. On the 24th of July, 2021 BTC/USD was trading near the 33,000.00 mark, on the 20th of July the cryptocurrency was trading near 29,300.00. If Bitcoin were too fall below this level, while some traders may believe it is an opportunity to buy an oversold market, bearish skeptics may turn their attention to June 2021 lows of 28,800.00 as another selling target.

Bitcoin has produced a solid bearish trend. Conservative traders may not believe BTC/USD has ultimately killed off the downwards slope, until it effectively trades above the 45,000.00 mark for a sustained period of time. Trading sentiment remains at best cautiously optimistic by bullish traders, but speculators who remain suspicious of BTC/USD may view its current levels as an interesting level to venture more selling positions. Because of volatility displayed only in the past week, traders are urged to remain cautious as they try and wager on the cryptocurrency in February.

BTC/USD Outlook for February

Speculative price range for BTC/USD is 26,250.00 to 49,490.00.

If the current price level of BTC/USD is not able to topple the 39,000.00 within the near term, this may be an interesting bearish signal. If the recent upwards momentum generated the past week is not sustained and the 37,000.00 falters, traders will certainly believe the 36,500.00 mark is a legitimate goal. If downside pressure continues to grow and the 34,000.00 were too prove vulnerable, last week’s test of nearly 33,000.00 would set off loud alarm bells if it is retested once again. Should Bitcoin happen to break below this value, traders should be braced for massive volatility.

If BTC/USD is able to break through the 39,000.00 value and hit 39,500.00, all eyes will be on 40,000.00. If this higher juncture is touched and penetrated, BTC/USD could see fast results upwards and the 42,000.00 to 43,000.00 marks could become a focus. If Bitcoin is able to establish a run towards the 45,000.00 juncture, this could spur on more speculative buying which may believe another trend upwards is about to become technically strong. A challenge of 49,000.00 would certainly get many Bitcoin proponents singing again.