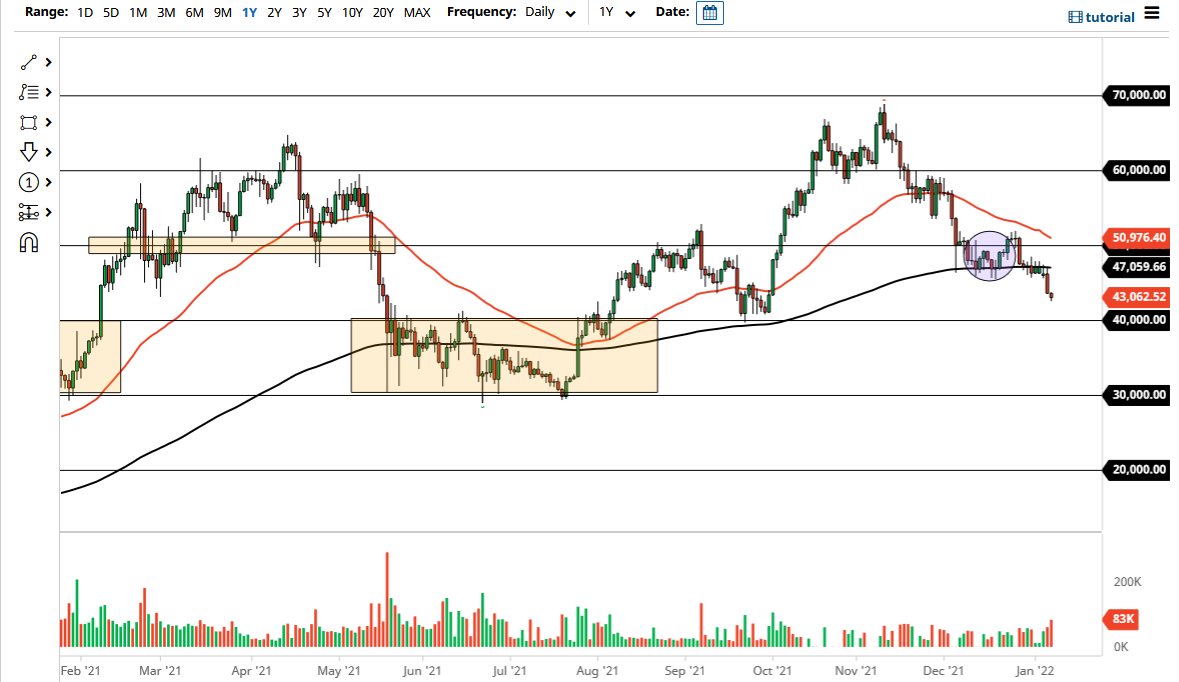

The Bitcoin market has reached towards the $43,000 level on Thursday, as we have broken down rather significantly. That being said, the question now is how much further will Bitcoin fall? There are a lot of concerns now that the Federal Reserve is talking about accelerating tightening monetary policy, and therefore a lot of institutional holders sold everything that they had anything close to a gain in. Bitcoin of course is not immune to this, nor is it immune to the idea of a strengthening US dollar. Because of this, Bitcoin has had a rough couple of days but at the end of the day, we are still very much looking as if there is significant support below.

If you have been following my Bitcoin analysis here at Daily Forex, you know that I had talked previously about the possibility of the $40,000 level being the “floor.” We will see if that holds true, but it certainly looks as if we may drift a little bit lower in order to find that. That is not uncommon for Bitcoin to lose 40% of its value, which would be roughly about what that would mean. At this point in time, I look at pullbacks like this as an opportunity to buy a little bit, but I do not necessarily jump “all in” in order to protect myself as Bitcoin can fall, or rise for that matter, much farther than we anticipated.

The 50 day EMA is driving lower, and it looks as if it is trying to get down to the 200 day EMA, forming the so-called “death cross.” That technical set up typically runs very late, and quite frankly you can lose a lot of money trading based on that alone. Bitcoin of course continues to attract a lot of inflows from retail traders, and I do think that institutional traders are going to come back into the fray rather soon. We are at the beginning of the year and people are going to have to put money to work, so once we get a little bit of stability in the financial markets on the whole, Bitcoin could be one of those beneficiaries out there if and when everything comes down. The job summer comes out on Friday so that may cause a little bit of noise in the US dollar, but ultimately it looks as if we are starting to at least get close to finding a bottom.