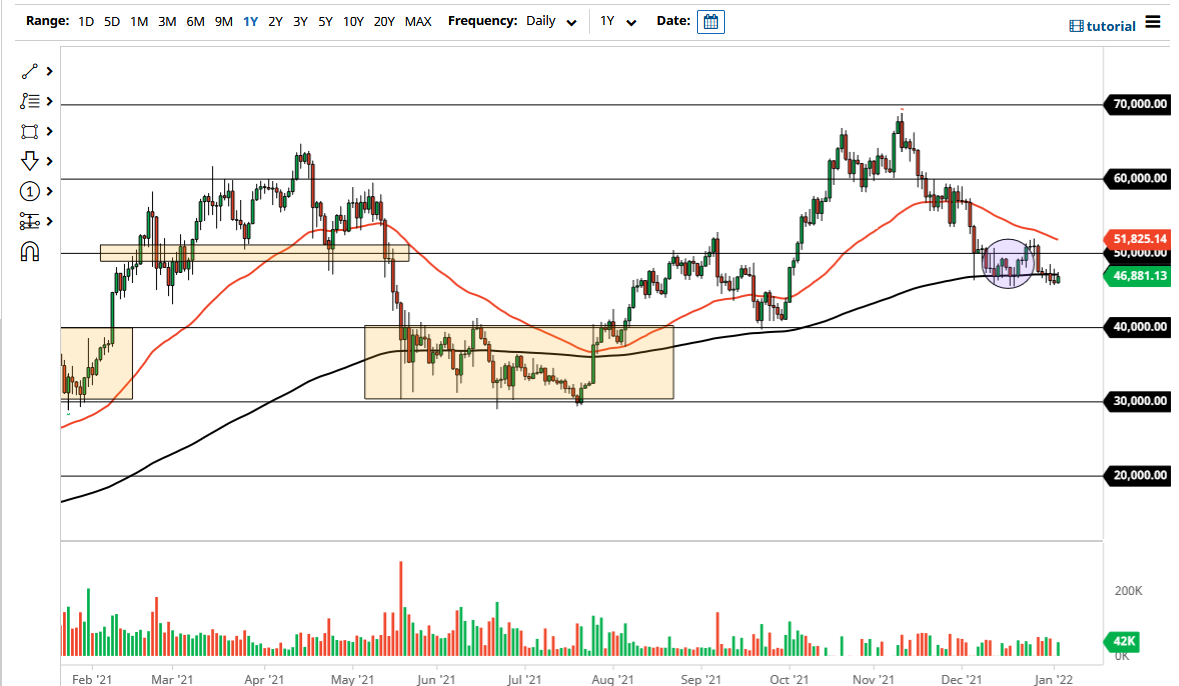

Bitcoin rallied a bit on Tuesday as we continue to use the 200-day EMA as a bit of a magnet for price. That being said, the market is continuing to look at the 200 day EMA as some type of guide, and it is worth noting that despite the fact that the market has looked extraordinarily weak over the last couple of weeks, the reality is that we still have not broken down, and that is something that is worth paying attention to.

If we can break above the 200 day EMA on a daily close, then it is very likely that we could go higher, reaching towards the crucial $50,000 psychological barrier. Breaking above that then opens up the possibility of a move much higher, breaking above the 50 day EMA which currently sits at the $51,825 level. Granted, even if all of this happens, it will take a certain amount of effort, but at the end of the day we are still very much hanging onto the uptrend, albeit barely, so you should be paying attention to the fact that the market cannot quite break down yet.

Even if it does break down a bit from here, the reality is that the $40,000 level underneath should be massive support, as it had previously been both support and resistance. There is also a significant amount of psychology around a large round number like $40,000, so that should come into the picture as well. This is possible, but I do not think it is very likely at this point in time.

Something that may help from the outside world is the fact that the US dollar has lost a little bit of strength, and that could help push Bitcoin higher. Nonetheless, we have had a major pullback as of late, and the longer-term Bitcoin holders will almost certainly be adding to their positions relatively soon. The market is not what I like shorting anytime soon, so it is worth paying close attention to any type of surge higher. Longer term, I do believe that we will eventually go back to the highs, but it is probably going to take a bit of momentum, and probably more importantly, time.