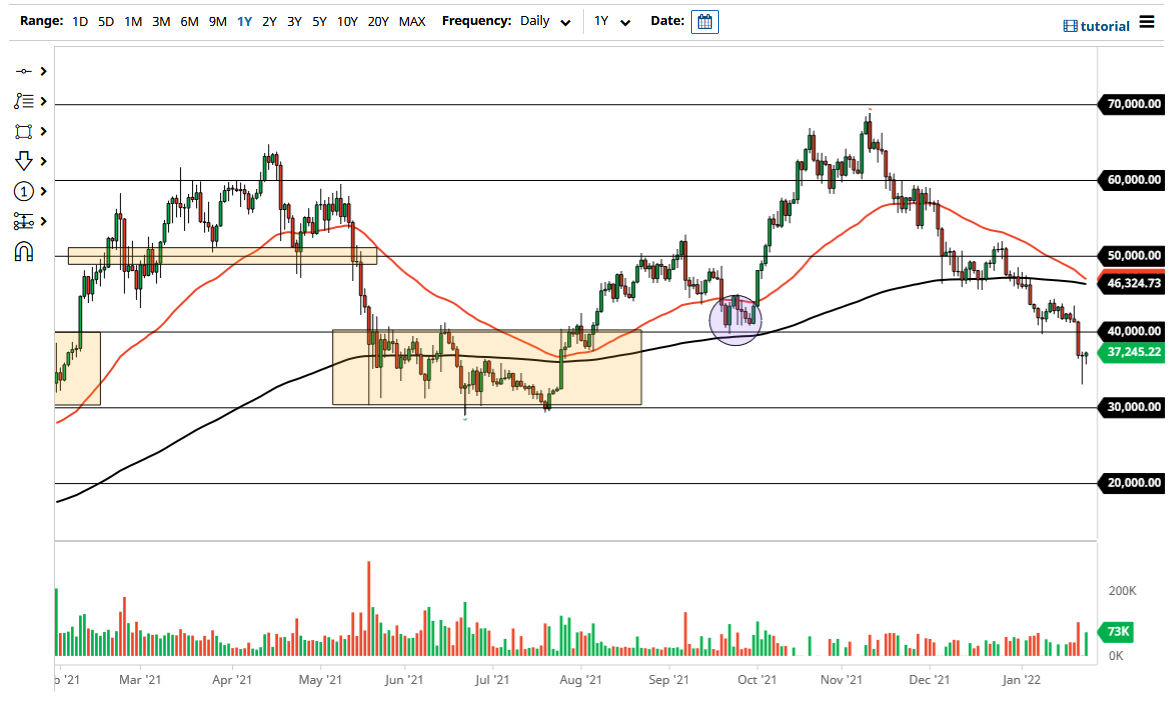

Bitcoin markets initially fell a bit on Tuesday but then turned around to show signs of life again. It is worth noting that we had formed a massive hammer on Monday, so I think at this point it is likely that we will get some type of short-term bounce. Obviously, the most important area just above is going to be the $40,000 level, which is an area where we have seen support several times, as well as resistance. I believe it will be resistance again, so it will be interesting to see whether or not we can break above there.

One of the most important events for Bitcoin over the next several days will be the Federal Reserve FOMC press conference. After all, the world is waiting to see whether or not the Federal Reserve is going to continue to sound hawkish, or if they are going to simply back off a bit after we have seen a major selloff in various indices and assets around the world. That being said, it is very likely that we will continue to see a lot of choppiness when it comes to Bitcoin and other assets, but clearly the market has gotten oversold, and it does make sense that we would see a bit of a bounce.

As we head into the Wednesday session, it's very likely that there will be a lot of hesitation, but if Jerome Powell looks even remotely less hawkish than he has over the last couple of months, then it is likely we will get a relief rally. At this point, I would be very hesitant to get overly bullish of Bitcoin, but it certainly looks as if we are trying to find some type of bottom. You would also be hard-pressed to find sentiment worse than it is right now, so it is likely that there are people out there accumulating. Nonetheless, it is important you do it very cautiously, because it is likely that we will continue to see volatility and could even see further selling going into the future. That being said, most of the damage has already been done, so it will be interesting to see how we move going forward. Either way caution is going to be crucial.