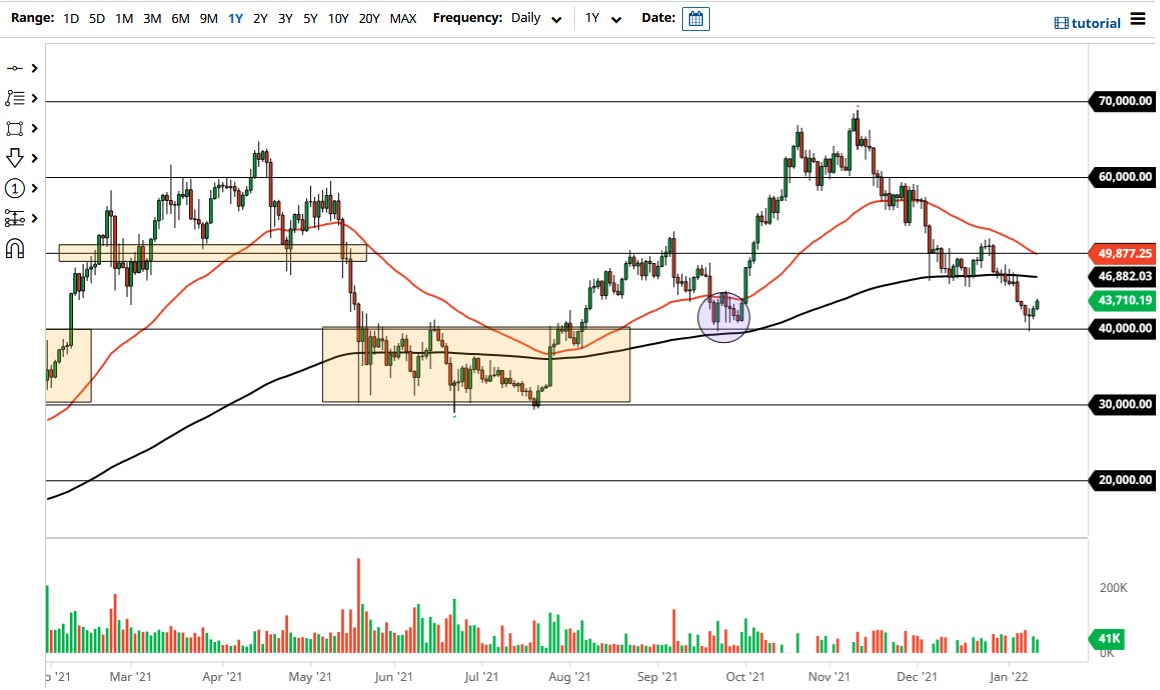

Bitcoin recovered quite nicely on Wednesday, gaining a little over 5% as the bottom looks to be trying to hold. The $40,000 level was a bit too much for sellers, and it now looks as if there is going to be a significant fight on our hands any time we get close to the $40,000 level. In fact, when you look at the chart you can make out a perfect “V pattern”, which is exactly what fractal traders look for. This has been a significant pullback, but the $40,000 level is an area that has mattered multiple times in the past.

Further exacerbating the idea of $40,000 holding is the fact that we did up forming a massive hammer at that level. Because of this, it looks to me like the market is probably going to try to recapture the 200 day EMA, which currently sits at the $46,882 level. The 50 day EMA is starting to sink towards the 200 day EMA, forming the so-called "death cross”, but we are not there yet and that indicator ends up being late more often than not. In fact, when you break down below the 50 day EMA, quite often (roughly 71% of the time) a market will be above it within one month. That is essentially what we are seeing here: at least an attempt to make some type of similar move.

If we were to somehow break down below the $40,000 level, it is very likely that Bitcoin would fall apart at that point, reaching towards the $30,000 level. The noise on places like Twitter and financial channels had gotten so deafening near the $40,000 level that I anticipated that we were probably closer to the bottom than most people realized at that time. While we cannot say that the bottom has been put in completely, it certainly looks like we are doing everything we can to make that happen. After all, Bitcoin is up 10% since touching the $40,000 level, roughly speaking. With that, I am very bullish of Bitcoin and think that if you are cautious, dipping your toe back into the water makes sense. Full disclosure: I have been putting my money into Ethereum, but they do tend to move in the same direction.