The German index went back and forth during the trading session on Thursday as we continue to see a lot of concerns and misunderstanding about risk appetite at the moment, which is probably going to be with us for a while. Germany of course is just as susceptible to the idea of tightening monetary policy around the world, which of course is being led by the Federal Reserve. There have been multiple central banks around the world that have tightened as of late, and while it does not necessarily directly affect the German economy, it does affect the idea of whether or not economies around the world are going to show high demand for German exports.

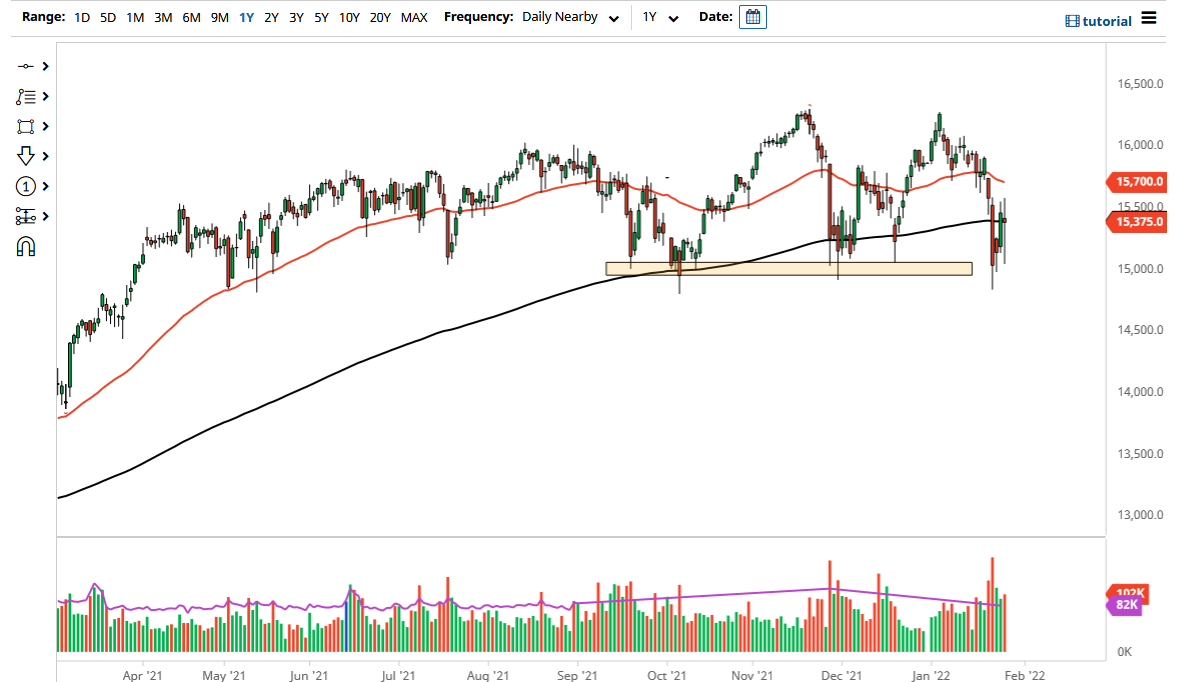

It is a bit of a knock on effect at this point, but quite frankly risk in general is being tested as several key assets continue to sell off. The 200 day EMA is presently about where we are sitting, and therefore it makes a certain amount of sense that we would see this market sit the way it is. The €15,000 level underneath continues to be supportive, and that is essentially where we bounce from at the lows of the session. The €15,600 level has been resistance during the course of the week, and that is where we pull back from at the highs of the day. At this juncture, it looks very much like the DAX is consolidating in order to either build a base or build up enough bearish pressure to finally break down.

This market is hanging at the bottom of the larger consolidation area and so far has been defending it. It is because of this that I believe the DAX will outperform any other indices around the world, with perhaps the main reason being that the European Central Bank is not looking to tighten monetary policy anytime soon, so it does give German companies a little bit of a “boost” in comparison to their American and other counterparts. If we do break down below the €15,000 level on a daily close, at that point in time it could open up another €500 lower, maybe even further than that. On the other hand, if we can break above the €15,600 level, then it is likely that we may make a move towards the €16,000 level, maybe even as high as the €16,250 level which is the top of the overall larger consolidation area.