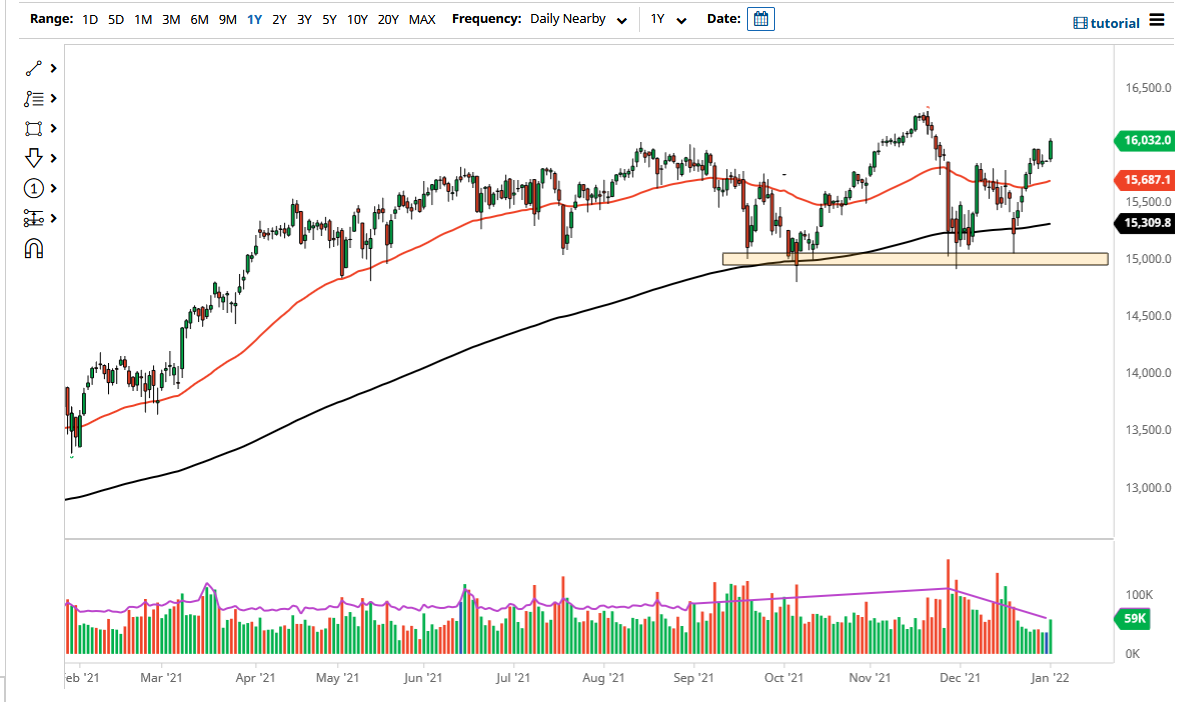

The DAX Index broke above the €16,000 level on Monday in what looks to be an attempt to continue breaking much higher. Quite frankly, this is a strong sign, considering that the DAX is considered to be the “blue-chip index” of the European Union in general. The fact that we broke above the crucial €16,000 level is a good sign and opens up the possibility of a move towards the €16,250 level above. That was the most recent high that the market dealt with, so there might be a little bit of minor resistance based upon psychology, but that is about all I expect there. Ultimately, in the short term, it looks as if any pullback at this point will more than likely simply offer an opportunity to pick up this market “on the cheap.”

The 50 day EMA currently sits at the €15,687 level and is starting to tilt higher. Because of this, the market is likely to see that act as a little bit of a “floor in the market” as it climbs. Regardless, it is obvious that we have had a pretty significant move during the day on Monday, and it certainly looks as if by the way we have closed, that we will probably continue to see a move to the upside. If we can clear the top of the candlestick for the day on Monday, I see absolutely nothing stopping us from reaching the highs.

Breaking above the highs allows the market to go looking towards the €16,500 level, and more likely than not, higher than that. You can see that underneath we had formed a massive “double bottom” at the €15,000 level and have yet to turn right back around. This is a good sign that perhaps we have hit the bottom in this market, so the most obvious place for a longer-term trader to pay attention to is going to end up being the €15,000 level. If that gets broken down, that would be very catastrophic for this market, perhaps opening up a massive bear market. We look nowhere close to doing that at this point in time, and you can even make an argument for a little bit of a bullish flag being broken during the day as well, so I do like the move to the upside.