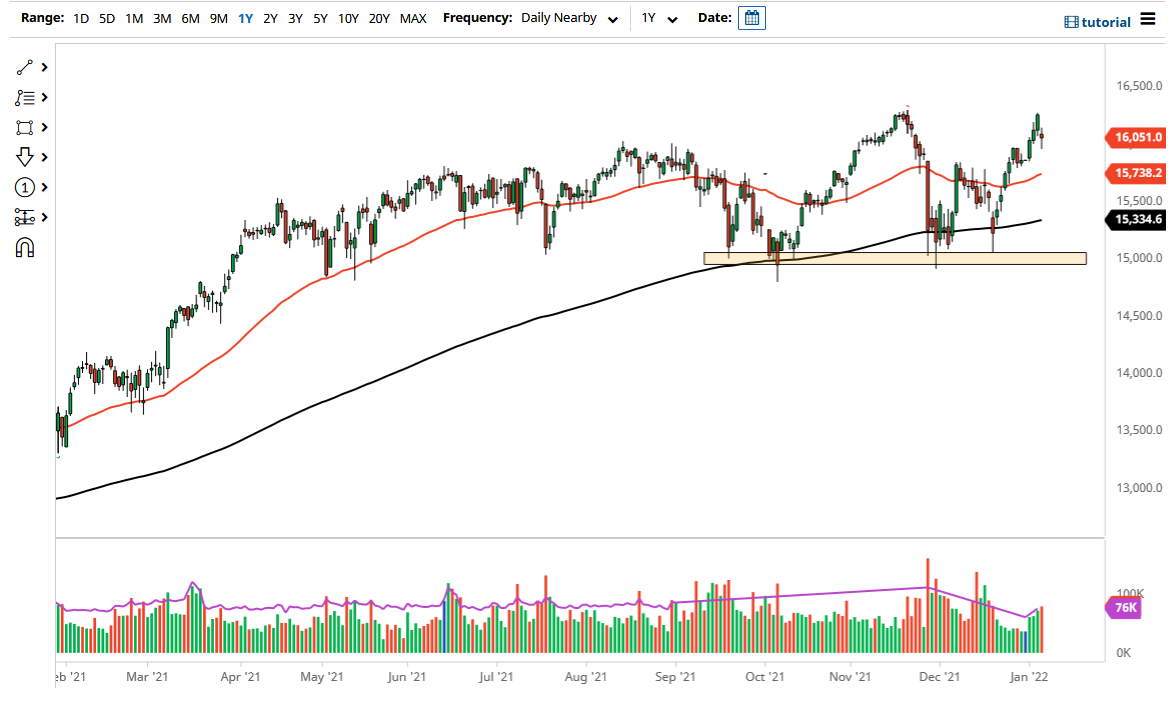

The German index gapped a little bit lower during the trading session on Thursday, but then fell rather significantly. That being said, it looks as if the DAX is finding support near the €16,000 level, which makes quite a bit of sense. Ultimately, this is a market that I think will continue to see plenty of buyers on dips as it offers a little bit of value. Quite frankly, the DAX is likely going to continue to find plenty of people willing to jump in every time there is a pullback due to the fact that a lot of traders will more than likely have missed a lot of the noise.

The 50 day EMA is currently curling higher and should offer plenty of dynamic support going forward. All things being equal, this is a market that will continue to go higher based upon the “W pattern” underneath that we had broken above, and the fact that we have challenged the high over the last couple of days. Given enough time, I do believe that we break out above the recent all-time high and continue to see the DAX drive much higher, challenging the €16,500 level.

Keep in mind that the DAX is one of the first places that money goes to work in the European Union, as Germany is considered to be the “engine of Europe.” The DAX is somewhat sensitive to exports though, so keeping an eye on the euro itself is not a bad idea. The euro is historically cheap right now, hanging around the $1.13 area. Because of this, it will make quite a bit of sense the German exporters do quite well, so I think that is part of what will be driving us higher.

I have no interest in shorting this market whatsoever, and therefore I think that this is a scenario where every time we dip there will be plenty of people getting involved. The candlestick for the day on Thursday is also a hammer, in and of itself an interesting set up from a technical standpoint. All things been equal, this is a market that I think continues to find plenty of upward momentum, but the pullback of the last couple of days was probably necessary because the market cannot go in one direction forever.