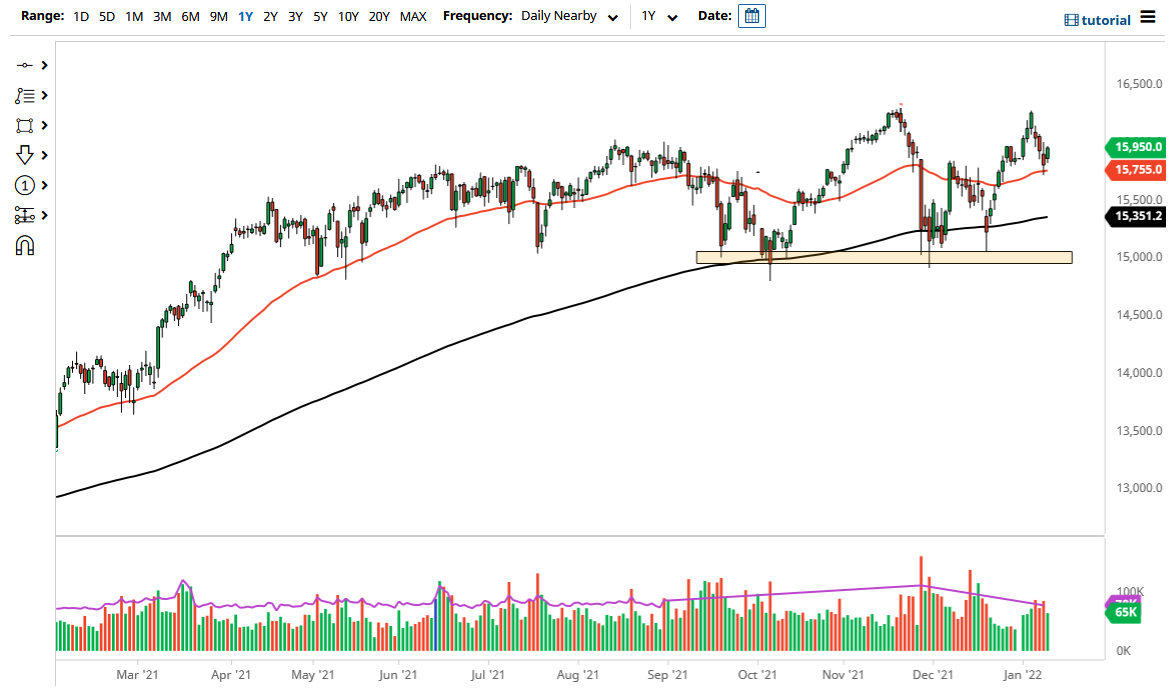

The German market initially dipped just slightly during the trading session on Tuesday, but then turned around to show signs of strength as we have broken above the €15,950 level. At this point, the market looks as if it is trying to bounce from here and continue going to the higher reaches of the €16,300 level, as we have bounced quite keenly from the 50 day EMA.

Looking at this chart, we have been bullish for quite some time, but had also been stuck in a bit of a range. What is interesting is that the market has pulled back just to the 50 day EMA initially, and then found enough buyers to make this a “higher low". It is also worth noting that same general area had previously been resistance, so I think at this point in time we are going to run towards the top of the range at the very least. That being said, keep in mind that the markets have become a little bit more “risk on” over the last day or so, so it does make a certain amount of sense that we see the DAX pick up right along with other risk assets. Ultimately, I do think that the DAX will lead the way in Europe, as it does tend to be the first place that people put money to work.

Breaking above the €16,300 level would not only be a “higher high”, but I would also be the market smashing for a double top, which of course is very bullish in and of itself and could send this market much higher. At that point, the “measured move” could be good for €1300, meaning that we could be looking towards the €17,600 level, perhaps even higher than that.

Regardless, I do not have any interest in shorting this market until we break out of the consolidation area that we are still technically in, to the downside. That would be a break of the €15,000 level, which of course is an area that has been tested multiple times, but perhaps more importantly for our purposes, is quite some distance away from where we are currently trading at. Because of this, I remain bullish and I think at this point in time you could even make a little bit of an argument for a bullish flag.