The German index has rallied during the session on Thursday, as we continue to hang on to the 50 day EMA. At this point, the DAX looks like it is going to be one of the better performers, which is probably not a huge surprise considering that the European Central Bank is not looking to tighten monetary policy, and as a result it is likely that we will continue to see this market be one of the bigger beneficiaries. After all, the DAX is the biggest index in Europe, as Germany is the biggest economy.

Not only of the DAX and important index, but it is something you should be watching in general due to the fact that the DAX will often proceed what happens in other indices in the European Union, as the DAX showing signs of strength will often have other people pushing towards riskier assets such as the IBEX in order to get even more alpha. The same can be said with the DAX is falling apart, because if people do not want to be involved in Germany, they certainly will not want to be involved in Spain, Italy, or other smaller indices such as Norway or Belgium.

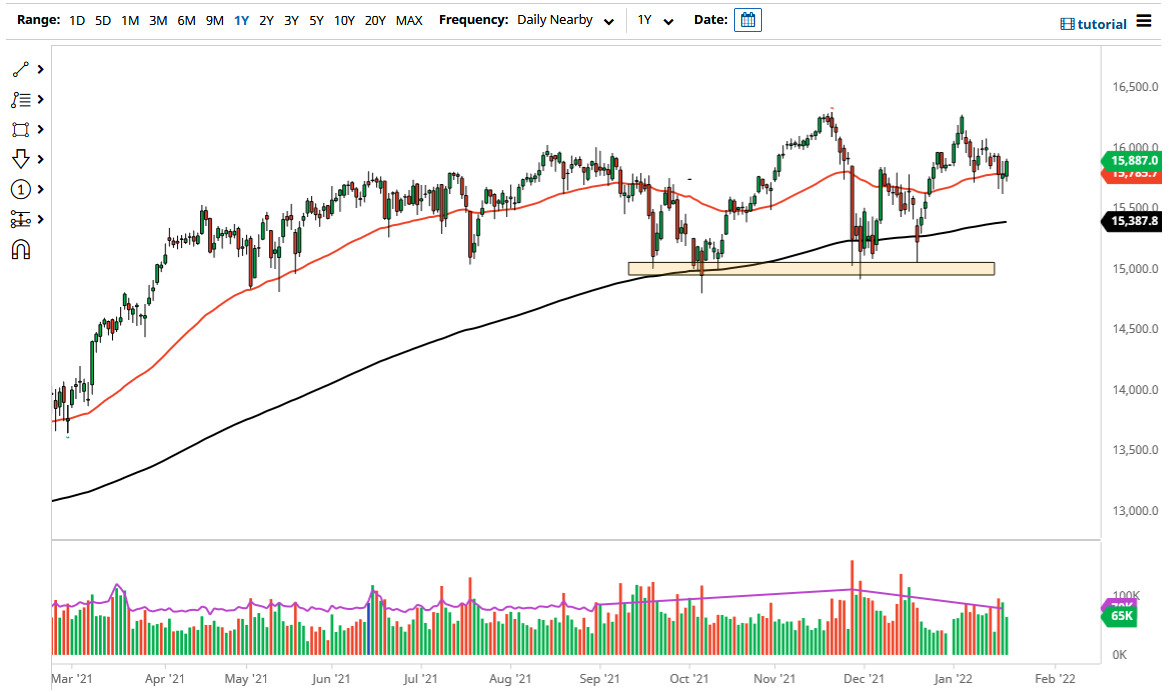

Looking at this chart, we formed a very nice neutral candlestick during the previous session on Wednesday, giving us a nice short-term support level at the €15,625 level. If we were to break down below there, then I think you just simply need to “reset” and take a bit of a breather and wait for support underneath. It is not until we break down below the €15,000 level that I consider the DAX to be “broken.”

More likely than not, we will make the attempt to break above the €15,950 level, which was the highs of the last several sessions earlier this week. If we can get above there, then we are likely to take out the €16,000 level, opening up a much bigger move. At that point, I would not only anticipate revisiting the €16,300 level, but breaking above there and perhaps sending the DAX towards the €16,500 level after that. If we do get that move, the DAX will probably be a strong performer for several weeks going forward, perhaps even the rest of the year.