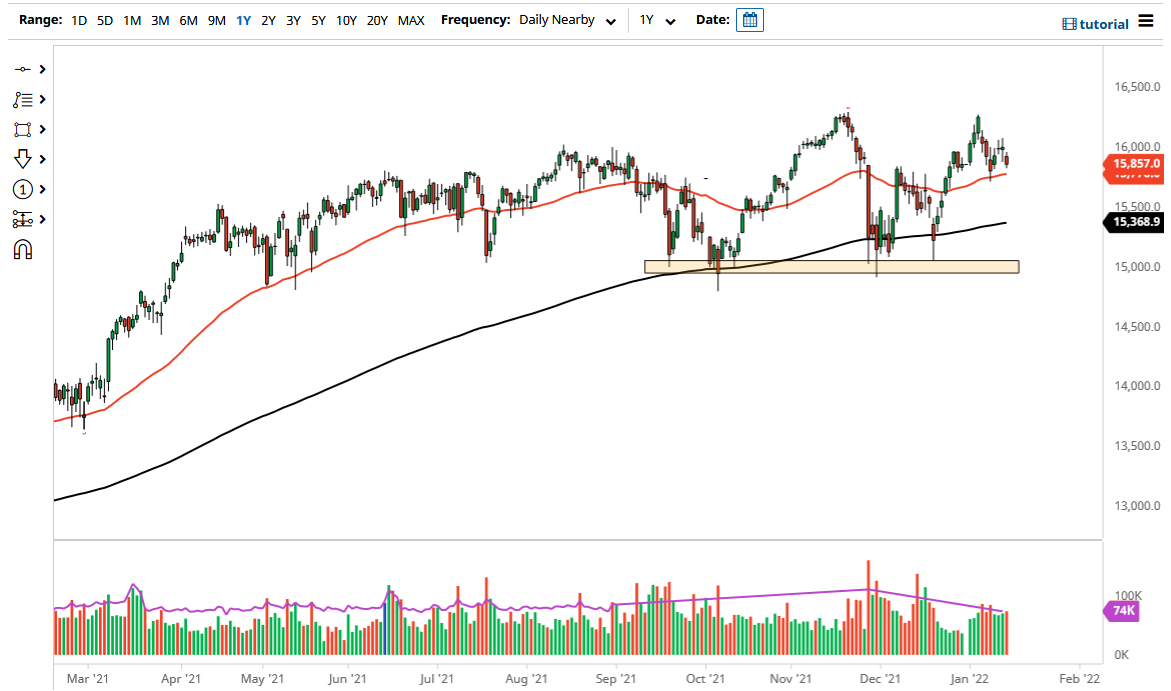

The German DAX Index fell a bit on Friday to reach down towards the €15,850 level. We are sitting just above the significant 50 day EMA, which of course is an indicator that a lot of technical analysts and technical traders will pay close attention to, so it does make sense that we would reach towards it. If we can stay above the 50 day EMA, that would obviously be a very bullish sign, as the market continues to try to break out to the upside. However, if we were to break down below the 50 day EMA, that could cause quite a bit of selling pressure and dump the DAX down to the €15,500 level.

Keep in mind that the DAX is more or less an export index, as there are lot of major corporations in Germany that export to not only other parts of the European Union, but worldwide. There is a bit of a correlation with the euro and whether or not it is strengthening against the greenback to the DAX, but perhaps more importantly, we also need to get a handle on global growth. The idea of a stronger global economy helps Germany, as it exports a lot of heavy machinery and industrial products.

You could make an argument for a little bit of a falling wedge sitting on top of the 50 day EMA which would attract a lot of attention, but quite frankly I do not know that I would put a lot of credence into that idea until we break above the €16,000 level. Keep in mind that the €16,000 level is an area that will attract a lot of attention due to the fact that it is a large, round, psychologically significant figure and of course an area where we had seen a couple of neutral candlesticks during the previous couple of sessions.

I do not necessarily want to short the DAX, but I do recognize that if we break down below the 50 day EMA there is probably going to be a short-term selling opportunity that I may take advantage of until we get down to that €15,500 region. I would also keep an eye on a lot of other indices around the world, as the DAX will probably rise or fall with most of the big ones.