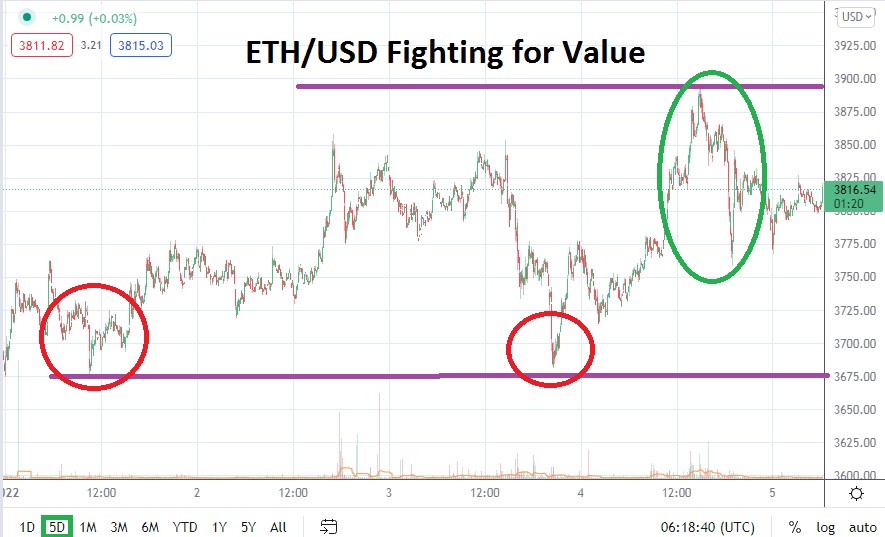

Speculative nervousness remains rather loud within the cryptocurrency landscape. ETH/USD has been fighting for higher value, but headwinds continue to incrementally lower resistance levels in the short term. Technically, ETH/USD appears to be within a slow moving bearish trend, but traders should not be fooled by charts into believing volatility has disappeared. ETH/USD traded at a high of nearly 3888.00 yesterday, this before declining again and falling to around 3755.00.

Reversals remain a strong theme with ETH/USD. While brief movements upwards are being demonstrated, the cryptocurrency seemingly has found it difficult to break resistance levels which can change behavioral sentiment in a strong manner. Major counterparts of Ethereum are also finding it difficult to gain traction higher in recent trading. The inability of ETH/USD to sustain a solid move upwards continues to indicate additional bearish momentum will be experienced.

On the 3rd of January, ETH/USD did fall to nearly 3675.00, but a bounce higher was certainly produced which resulted in yesterday’s apex. An intriguing sign within ETH/USD is that the cryptocurrency has struggled to maintain value over the 3900.00 juncture in the past week of trading. On the 27th of December ETH/USD was around the 4125.00 vicinity when a violent selloff took place. On the 28th of December, ETH/USD struggled around the 3900.00 range, but then suffered another selloff which saw its value fall to a low of nearly 3775.00 on that day. Since then ETH/USD has actually produced a price range which has been lower.

Lows testing the 3610.00 level have been produced a couple of times since the 29th of December. While the low of ‘only’ 3685.00 was made on the 3rd of January, it is troubling that ETH/USD remains within sight of depths which were last sincerely traded in October of 2021. Current resistance should be watched around the 3840.00 level. If this nearby barrier higher remains durable it could cause further nervousness and spark aggressive selling positions.

ETH/USD has the ability to be volatile. Spikes can certainly take place which serve as a strong counterpunch. Conservative speculators who want to sell ETH/USD should use stop loss orders to protect against the potential of sudden bursts higher. However, short-term traders may be making the correct wager by looking to sell ETH/USD and aiming for support levels as take profit targets. If ETH/USD falls below 3800.00 and sustains values below, the cryptocurrency could traverse lower and test depths seen only a couple of days ago.

Ethereum Short-Term Outlook

Current Resistance: 3856.00

Current Support: 3771.00

High Target: 3902.00

Low Target: 3645.00