The Ethereum market rallied pretty significantly in the sense that we are closing at the top of the range. That being said, it is possible that we could see a bit of sideways action in order to try to form a base, but I am not convinced yet. We have to have more of a “risk on” type of situation, and it is likely that we will see a selloff given enough time. If we get any type of exhaustion on a rally, I think it is probably going to be an opportunity to short this crypto, assuming that you even do that.

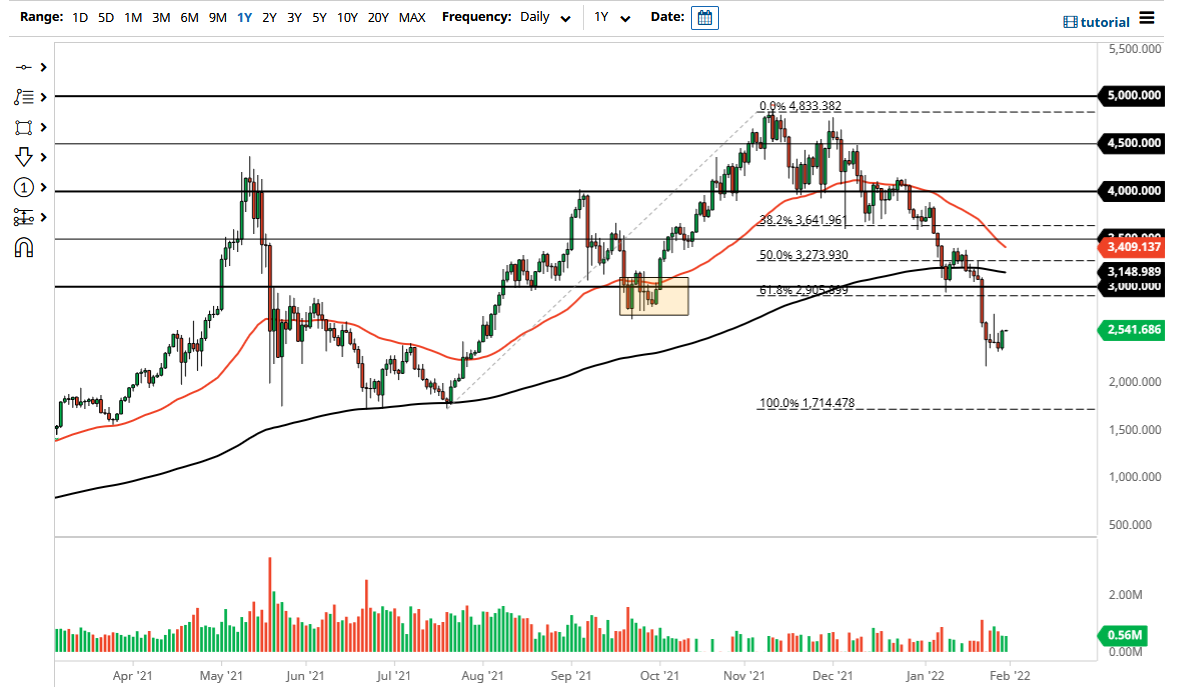

To the downside, if we were to break down below the Monday candlestick, then the market is likely to continue going much lower, down to the $2000 level, maybe even the $1750 level. This is a market that looks like it is trying to find the bottom, and whether or not we have done so in this area is a completely different question. I do think that the $1750 level is much more appealing, but at this point it does look like Ethereum is at least trying to stabilize and maybe get a little bit of a bounce. No market goes in one direction forever, so the fact that we are going sideways should not be a bit of a surprise.

At this point, it is likely that we see only somewhat limited follow-through. Pay attention to the Bitcoin market, because it needs to be strong in order for Ethereum to be strong. If we were to break above the 200 day EMA at the $3148 level, then I might be convinced to start buying for a bigger move, but I just do not see the catalyst at this point in time. The US dollar looks as if it is ready to continue strengthening, and the Federal Reserve tightening is only going to add more fuel to the fire. Although the candlestick was very positive for the trading session on Friday, the reality is that it is still very much in the same range that we have been in for the last couple of days. Whether or not that holds will be something worth paying attention to.