Ethereum rallied a bit on Wednesday as we await the FOMC meeting. Most crypto traders do not pay too much attention to the Federal Reserve, and it has been to their detriment over the last several weeks. Because of this, a lot of people will be paying close attention to Jerome Powell and what he has to say, because the tighter monetary policy gets, the more traders dump risk assets, which includes all crypto.

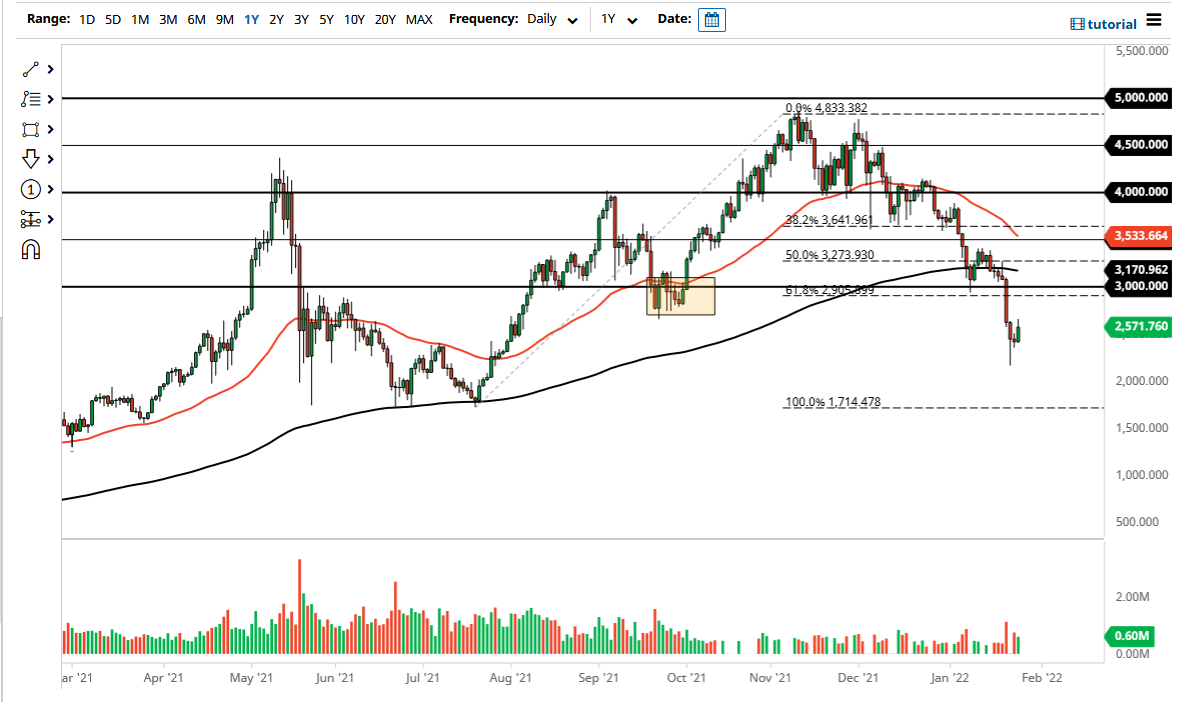

That being said, the market is oversold, so it does make sense that we would see sideways action right around this level. That being said, the $2500 level is only a psychological level, so we need to see the Fed loosen monetary policy for a sustainable rally. If we were to break above the $3000 level, that might be reason enough to think about going long, but really at this point we have to cross that bridge when we get there. I think there will be a lot of questions at that point, and we will have to decide whether or not we can continue, or if we get some sign of exhaustion.

I think the market will probably see a lot of volatility, but even if we do rally, I may be a little bit skeptical in the beginning unless the overall risk appetite of the markets changes. Looking at this chart, if we turn around and break down below that hammer that formed on Monday, that could lead to a bigger flush lower, perhaps opening up the door to the 2000 level, followed by the $1750 region. At that point in time, if support gives way, Ethereum is going to collapse, and we will almost certainly hit a major “crypto winter.” If we do, I can promise you that this time I will back up the truck and continue to accumulate for the longer term.

If we do capture the 200 day EMA above, currently at the $3171 level, it will bring in a lot of algorithmic trading and send this market higher. That being said, it is very unlikely that will happen easily, simply because we have seen so much negativity in not only this market, but most markets.