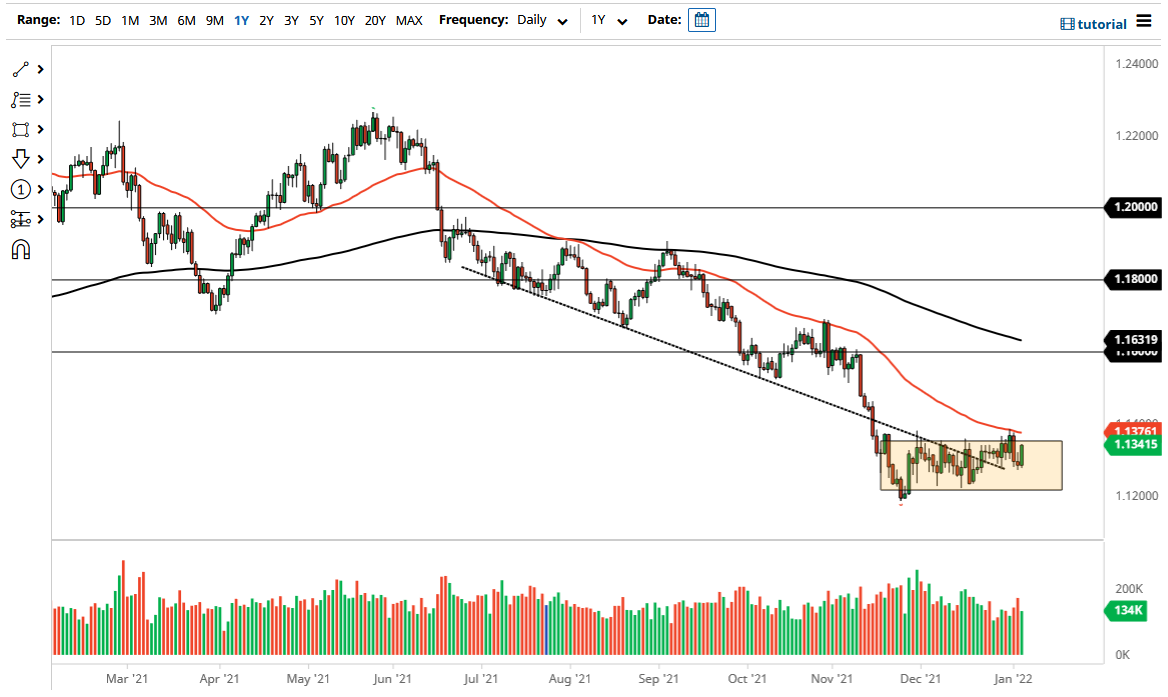

The euro rallied significantly on Wednesday to reach towards the top of what has been a relatively well-defined trading range. Because of this, I think that the market is trying to front run the jobs number on Friday, perhaps giving us a little bit of a “heads up” on what is about to happen with the euro, and then perhaps even the US dollar itself.

Looking at this chart, it is obvious that the 50 day EMA is coming into focus again, which sits at the 1.1376 handle and looks as if it is tilting lower. The 1.1375 level is the beginning of significant resistance that I think extends all the way to the psychologically important 1.14 handle. If we can clear all of that, then it would obviously be a very bullish turn of events and could send the euro looking towards the 1.16 level. Keep in mind that the Friday session will almost certainly be very noisy, but by the end of the week, if we can clear all of that noise, this would be extraordinarily bullish.

To the downside, there is a significant amount of support at the 1.1225 handle, which is where we have been bouncing from multiple times. If we were to clear all of that noisy behavior, then it could open up a move to the 1.12 handle. Breaking down below that level, it is very likely that we will go looking towards the 1.10 level underneath, which will attract a lot of attention from a psychological standpoint. Ultimately, this is a market that I think continues to see a lot of noisy behavior, and we are still very much in consolidation despite the fact that the Wednesday candlestick was so bullish. However, whether or not we can break out is a completely different question, but I would point out that the lows are gradually starting to “bend” to the upside, so maybe that gives us a little bit of a look into the future. Ultimately, this is a market that I think continues to see a lot of noisy behavior, but at this point I think we are about to make a decision for the entire quarter, so certainly this is a chart worth watching.