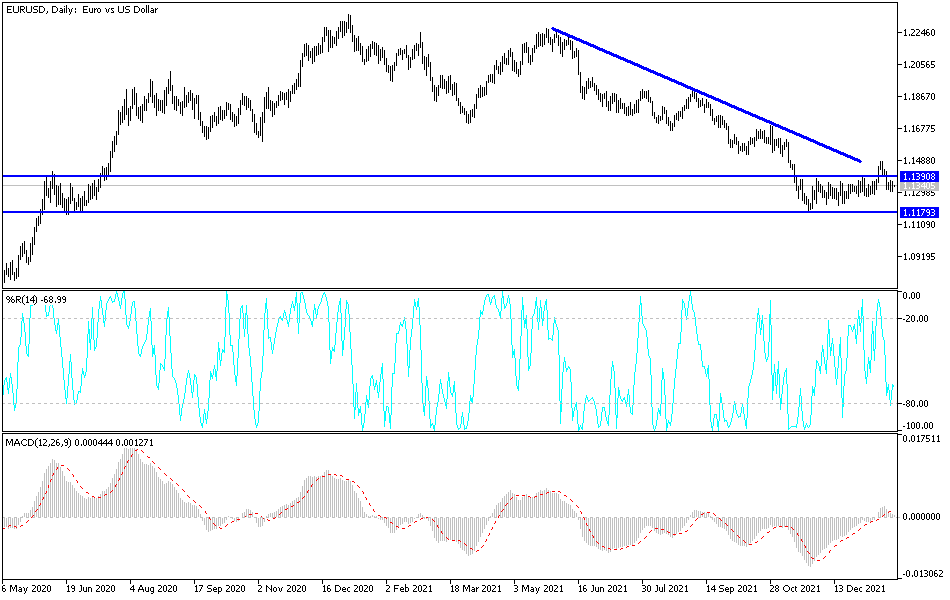

During last week's trading, the price of the EUR/USD currency pair was exposed to selling operations that are considered profit taking, coinciding with the recovery of the US dollar. Investors now prefer to wait for the results of the US Federal Reserve meeting this week and its directions for the future of tightening its policy. The euro-dollar pair retreated to the vicinity of the psychological support 1.1300 again, after its strongest gains recently, reaching the resistance level of 1.1482, its highest in two months.

As for the euro-dollar exchange rate, the gap between central banks on each side of the Atlantic is expected to become an even more dreadful headwind that could rule out any possibility of recovery in the coming months. On Friday, the euro recovered relatively even as the lingering slide in global stock markets continued and some commodity prices came under pressure, though it ended the week's trading lower against several major currencies including the dollar.

While risk aversion in global markets helped the euro tepidly advance against many of its peers on Friday, it previously lagged behind everything except the Swedish krona and was unable to benefit from earlier dips in the US dollar exchange rates. One possible reason for this is the European Central Bank's (ECB) monetary policy, which was reaffirmed with exhausting clarity last week, which could become even larger headwinds for the single currency over the coming months.

Last Thursday, European Central Bank President Christine Lagarde reportedly reiterated, in an interview with France Inter radio station, that Europe's economies are expected to avoid the bad inflation rates seen in the US in recent months. This is why the European Central Bank feels able to wait patiently for inflation to decline on its own even as price hikes are leading the Federal Reserve (Fed) to scramble to withdraw the monetary policy support it has provided to the US and global economies since the start of the pandemic.

The United States did not go through a debt crisis from 2010 to 2012, and the Federal Reserve did not have to intervene to control it. As a result, the Federal Reserve has no doubt that when implementing its monetary policy, it is thinking that asset purchases can be done for anything other than monetary policy.

According to the technical analysis of the pair: The support level of 1.1300 is still very important for the bears to move the EUR/USD to stronger bearish levels, and the closest to them are currently 1.1275 and 1.1180, respectively. It is known that the last level event will bring the strength to move towards the psychological support 1.1000 as soon as possible. On the upside, and according to the performance on the daily chart, the resistance levels 1.1490 and 1.1660 will be the most important to cause a change in the general trend of the pair, which is still bearish.