The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

There are a few valid long-term trends in the market, so it can be a profitable time to trade right now.

Big Picture 9th January 2022

Despite the start of a new calendar year and the end of a major holiday period, last week’s market was relatively quiet, despite two pieces of high impact data being released: the FOMC meeting minutes and non-farm payrolls data. Although both these releases contained surprises, neither of them had much impact upon the Forex market, but the FOMC minutes did send the US stock market firmly lower upon its release as it indicated a more hawkish tilt to the Federal Reserve’s monetary policy. The NFP release showed a big undershoot in number of net new jobs created, but also a stronger than expected rise in average hourly earnings data.

The US dollar rose slightly, in line with its long-term bullish trend.

Risk sentiment worsened over the week, especially following the hawkish FOMC meeting minutes release, after holding up well during most of the month of December. Most stock markets ended the week lower, including the benchmark US S&P 500 Index. The NASDAQ 100 tech Index fell strongly. Commodities were mixed, but crude oil rose which was unusual in a risk-off environment. In the Forex market the Australian dollar fell, while the British pound was strong. Risk sentiment did not really explain the week’s movements in the Forex market.

The omicron coronavirus variant has spread very quickly, sending new cases soaring to record highs. However, it appears the risk of severe disease is now considerably lower due to the nature of the variant and widespread vaccination, so it seems to not be hurting risk sentiment much although it has triggered new restrictions in many countries, especially in Europe.

I wrote in my previous piece last week that the best trade for the week was likely to be long of the S&P 500 Index following a daily close above 4800, and the USD/JPY currency pair following a daily (New York) close above 115.25. This was a good and profitable call as the USD/JPY currency closed at 115.31 on Monday and ended the week higher at 115.48, giving a gain of 0.15%.

Fundamental Analysis & Market Sentiment

The headline takeaways from last week were:

- The FOMC meeting minutes showed the committee describes the current historically high rate of US inflation as no longer “transitory”, and intends to begin unwinding the Fed’s balance sheet in March this year. This represents a more hawkish tilt on monetary policy by the Fed which may support the US dollar and keep the US stock market from rising to new highs.

- US non-farm payrolls data came in considerably lower than had been expected, at only 199k net new jobs created compared to the forecasted 426k. However, the unemployment rate fell further than expected and currently stands at only 3.9% compared to the anticipated 4.1%, while average hourly earnings increased by 0.6% when only a 0.4% increase had been expected.

- Global data continues to show that the fast-spreading omicron coronavirus variant is 70% less likely than previous strains to cause serious disease requiring hospitalization. This means that despite the massive spread of contagion, market sentiment is not really being affected as economies seem to be able to continue functioning without large scale disruption.

- The omicron coronavirus variant continues to spread rapidly around the world. Several European countries and Canada have imposed restrictions on movement and new cases are reaching all-time records by far, with well over two million new confirmed cases currently being reported globally.

The coming week is likely to see a somewhat higher level of volatility, with market direction likely to be determined on Wednesday when crucial US CPI (inflation) data will be released. The only other major data release due over this week is US retail sales data which will be released Friday.

Last week saw the global number of confirmed new coronavirus cases rise to its highest level ever seen, with over 2.5 million new daily infections confirmed on Friday. Approximately 59.1% of the global population has now received at least one vaccination.

The strongest growths in new confirmed coronavirus cases overall right now are happening in Algeria, Argentina, Australia, Austria, the Bahamas, Bahrain, Barbados, Belgium, Belize, Bolivia, Bulgaria, Burkina Faso, Canada, Colombia, Costa Rica, Croatia, Cyprus, Dominican Republic, Estonia, Fiji, Finland, France, Greece, Iceland, Israel, Italy, Jamaica, Kuwait, Latvia, Lebanon, Lithuania, Luxembourg, Mali, Mexico, Montenegro, Morocco, Netherlands, Niger, North Macedonia, Norway, Panama, Paraguay, Peru, Philippines, Qatar, Saudi Arabia, Senegal, Serbia, Slovenia, Spain, Sweden, Switzerland, Turkey, the UAE, the USA, Uruguay, and the UK.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a weakly bullish near-pin candlestick last week, after previously rejecting the resistance level identified at 12257 three weeks ago. Note how this key resistance level has held again – in fact, it held just after the FOMC release some weeks ago when it was tested, which may be a bearish sign. While this decline is not enough to invalidate the long-term trend (the price is still well above its levels from 3 and 6 months ago), it is very notable that there is clearly strong resistance here, which is having impact. This suggests that despite the long-term bullish trend, we may now have experienced a major bearish reversal. However, it is also worth noting that the price is now very close to a major support level at 12150 which continues to hold, so we may be seeing a consolidation between 12150 and 12257.

Overall, I would not look towards the USD as a key driver for any trades over the coming week.

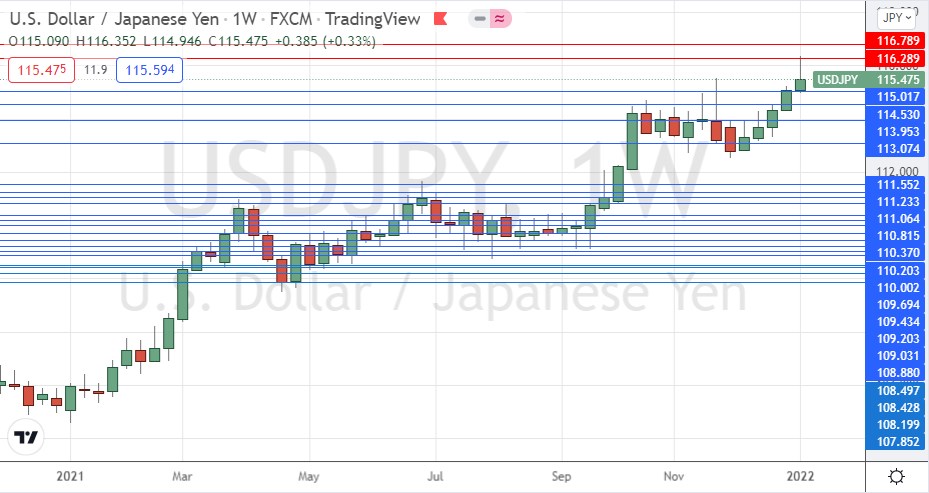

USD/JPY

The USD/JPY currency pair made its highest weekly close in 5 years for the third week running, but the candlestick formed is a pin candlestick which looks only weakly bullish, if at all. We do see a strong bullish trend, but the souring of risk sentiment last week had the effect of boosting the Japanese yen, so I do not want to go long here until we see a daily (New York) close above the nearest key resistance level at 116.29.

USD/JPY Weekly Chart

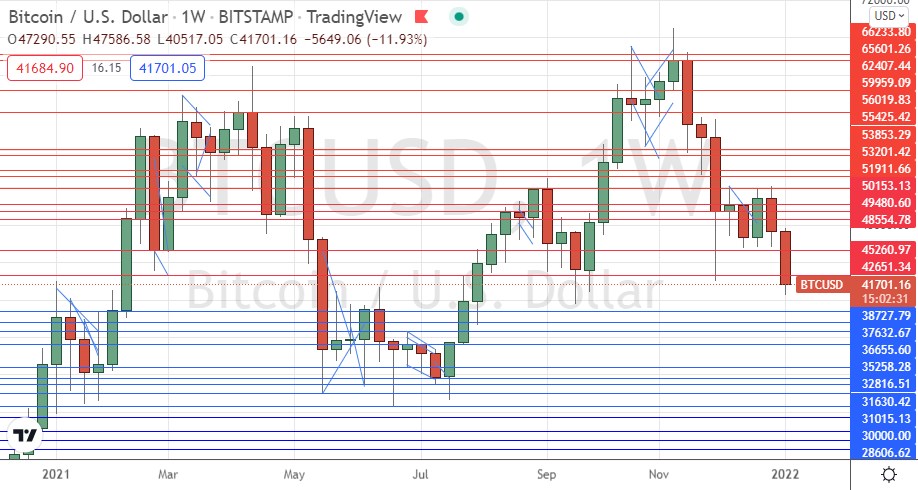

BTC/USD

Bitcoin fell again last week for the second consecutive week, finally breaking below the key support level at $42,651 which now looks like it has flipped cleanly to become new resistance. Bitcoin has just made its lowest weekly close since July 2021. These are clearly bearish signs, but I see the nearest support level at $38,728 as likely to be very important. If this support level breaks down, I can see the price continuing lower to reach the base at about $32k which was formed last summer.

If we get a bullish daily candlestick bouncing off $38,728 that could be a long-shot long trade entry with a good potential reward to risk ratio. Alternatively, a daily close in BTC/USD below $38,728 could be a good short trade entry signal targeting $32k.

BTC/USD Weekly Chart

Bottom Line

I see the best opportunities in the financial markets this week as likely to be long of the USD/JPY currency pair following a daily (New York) close above 116.29 or short of BTC/USD following a daily (New York) close below $38,728.