Gold futures tried to rise again towards the psychological resistance of 1800 US dollars. The price of gold settled around the level of 1802 dollars an ounce at the time of writing the analysis. The gains came despite the rise of the US dollar and the rise in treasury bond yields, which is the reason for reducing the gains. Gold prices are starting to come out of a weekly loss, dropping by about 2% at the start of the year. Silver, the sister commodity to gold, is also trying to stay above the crucial $22 level. Overall, the white metal has continued its downtrend from last year, dropping by 4.5% in the first few sessions of 2022.

Gold and the metals market in general have been affected by the quantitative tightening used by the US Federal Reserve and other central banks. However, the potential tapering off prospects amid a disappointing December jobs report and the broad effects of the Omicron variable could support the gold market.

However, the two main developments affecting the gold markets are the dollar and US bonds. Commenting on them, the US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, rose to 96.21, and the DXY Dollar Index was trading relatively flat in the first part of 2022. Overall, a stronger profit is bad for dollar-priced commodities because it makes buying it more expensive for foreign investors.

The other factor was that the rise in Treasury yields hurt the metals, as the 10-year bond yield rose to 1.805%. One-year bond yields rose to 0.425%, while 30-year yields rose to 2.149%. Increasing rates are generally bearish for metals because they raise the opportunity cost of holding non-yielding bullion.

Looking ahead, it will be a crucial week for gold and financial markets in general as US inflation and retail sales data will be released. Early estimates put the Consumer Price Index (CPI) at 7%, while retail sales will be flat at 0%.

In other metals markets, copper futures fell to $4.3695 a pound. Platinum futures fell to $926.90 an ounce. Palladium futures fell to $1,917.00 an ounce.

On the other hand, stocks were on their way to their longest losing streak since September, as the prospects of rising interest rates and inflation destabilized global markets. Some companies' warnings about the negative effects of the Omicron coronavirus variant also soured sentiment. The S&P 500 fell for the fifth day in a row, as shares of giant companies such as Apple Inc. and Amazon.com Inc with more than 2 percent.

The rapidly spreading Omicron strain is adding to concern about corporate earnings. Markets face higher volatility as the pandemic liquidity that has pushed stocks to record highs is withdrawn. The Fed is likely to raise interest rates four times this year and will begin the balance sheet reset process in July, if not sooner, and according to Goldman Sachs Group Inc., it is expected to increase further in December, putting additional pressure on the bank. Central to tighten policy.

In the past three decades, there have been four distinct periods of Fed rate hikes. On average, technology, which has come under pressure amid prospects of faster price increases, is among the top-performing sectors during those cycles, and this week there will be Federal Reserve Chairman Jerome Powell's hearing at the Senate Banking Committee on Tuesday.

Wall Street and stock markets are closely watching the Federal Reserve for clues about when it might raise interest rates. The US central bank has already said it will speed up reducing its bond purchases, helping to keep interest rates low. The market is now setting the odds that the Fed will raise short-term rates by at least a quarter point in March at around 78%.

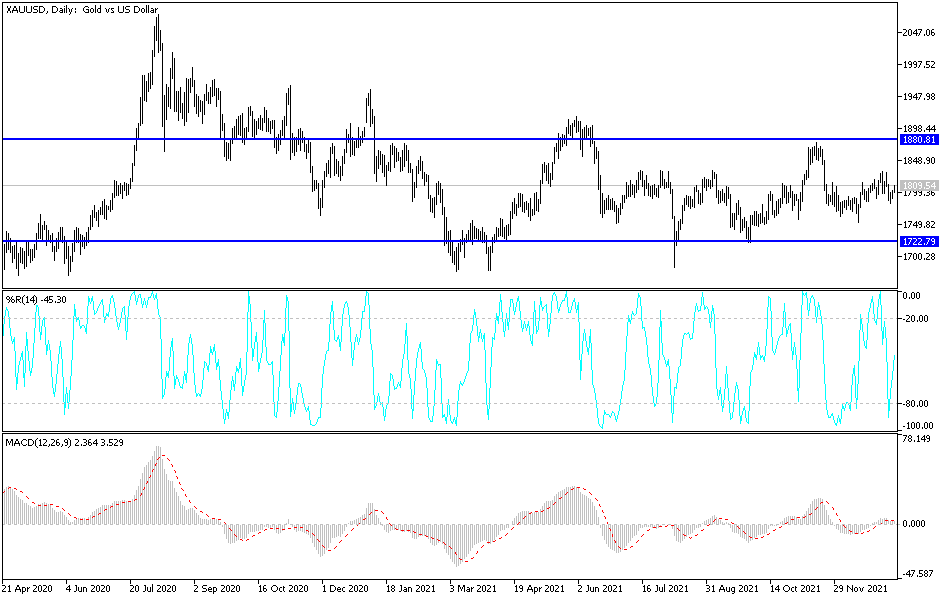

According to gold technical analysis: On the daily chart, the price of gold has returned to the neutral zone, and the tendency may be more to the downside if prices fall to the support levels of 1782 and 1775 dollars, respectively. From the last and lowest level, I still prefer buying gold again. On the upside, stability will remain above the psychological resistance of 1800 dollars, the most important for the bulls to control the performance again, and thus move towards levels that increase their control over the performance of 1818, 1827 and 1845 dollars, respectively.

The price of gold may be affected today by the price of the US dollar in response to Jerome Powell’s testimony and the extent of investors’ appetite for risk or not, in addition to developments regarding the rapid spread of the Corona variable and global restrictions on containment.