The price of gold gave up some of its gains after US Federal Reserve officials said that a strengthening economy and rising inflation could spur faster increases in US interest rates. The price of an ounce of gold settles around the level of 1808 dollars, after its strong gains towards the resistance of 1830 dollars an ounce in the same trading session. Raising the US interest rate is supportive of the US dollar and thus negatively pressures the gold price.

Officials highlighted the view in the minutes of the December 14-15 meeting of the US Federal Reserve's FOMC, which were published on Wednesday. Gold bars plunged last year in their biggest annual decline since 2015 as central banks began to back off from pandemic-era stimulus to fight inflation. Higher prices can dampen demand for the metal because it does not pay interest.

Commenting on this, Jay Hatfield, CEO of Infrastructure Capital Management in New York, said the market was interpreting that “it is very likely that there will be a rally in March followed by quantitative tightening, which is very bad for stocks and gold.” The yellow metal's advance came during regular trading although the payroll processor ADP released a report that showed much stronger-than-expected US private sector job growth in December. The ADP said that US private sector employment rose by 807,000 jobs in December after jumping by an adjusted 505,000 jobs in November.

Economists had expected employment in the private sector to increase by 400,000 jobs compared to an addition of 534 thousand jobs originally reported for the previous month. “The labor market strengthened in December as the delta variable repercussions faded and the Omicron effect was not yet visible,” said Nella Richardson, chief economist at ADP.

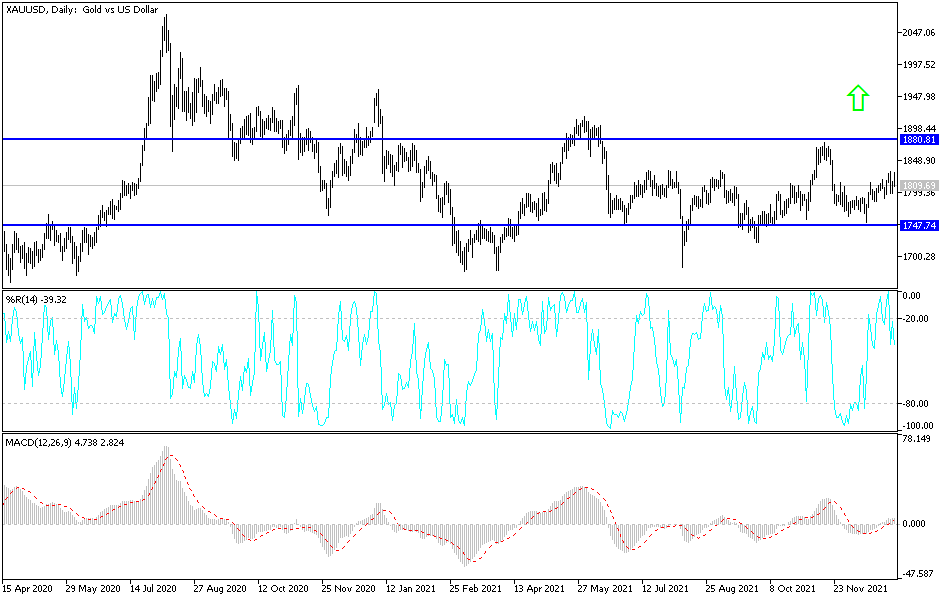

Gold technical analysis: Despite the recent performance, the gold market still can achieve strong gains as long as it sticks to the psychological top of 1800 dollars an ounce. This may bring technical buying deals and move prices towards stronger upward levels. Gold's gains were halted in light of the recovery of the US dollar and the relative calm due to fears of the new variant of the Corona virus Omicron. The closest rising levels for bulls currently, as I mentioned in the technical analyzes of the yellow metal, are 1818, 1827 and 1845 dollars, respectively.

On the other hand, bullish expectations may suffer a setback if the gold price falls to the support area of $1,775 an ounce. I still prefer buying gold from every bearish level. The gold market will be affected today by the level of the US dollar and the extent of investors' appetite for risk or not, as well as the reaction from the announcement of the number of US jobless claims and the ISM PMI for services.