There is no doubt that the return of the US dollar’s recovery is an important factor to stop the pace of the recent gains in the price of an ounce of gold. The price fell towards the level of 1805 dollars yesterday, before settling around the level of 1815 dollars per ounce at the time of writing the analysis. We are waiting for any news about the level of the dollar and the extent to which investors take risks or not.

Gold prices have fallen recently, weighed down by dollar gains and rising US Treasury yields amid bets that the Fed will raise interest rates as soon as March. Yields on the two-year bond, which track expectations for short-term interest rates, exceeded 1 percent for the first time since February 2020, reflecting expectations of a Fed policy rate hike as soon as March. Treasuries have fallen across the curve, pushing 2-year and 10-year bond yields to levels last seen before the pandemic hit the markets.

Prior to that, the Bank of Japan kept its monetary policy unchanged, but raised inflation expectations that reflect higher energy prices and other elements. The bank's board, which is governed by Haruhiko Kuroda, voted 8-1 to keep the interest rate at -0.1 percent on current accounts held by financial institutions at the central bank. With regard to the balance of risks, the bank said that the risks to economic activity tend to the downside at the present time, and that risks to prices are generally balanced.

On the global gold demand front, gold demand in India will be resilient against the latest onslaught of Covid-19 cases as buyers in the second largest consumer "learn to live with the virus," according to the World Gold Council. While regional governments across the country have imposed some restrictions on economic and other activities to contain the recent surge in infections, the restrictions have been less stringent. This is helped by gold sales, which are expected to rebound again in 2021 after taking a hit for nearly two years as the coronavirus has postponed many weddings, a major source of demand.

Experts expect the Omicron-led sudden wave of virus in India to reach its peak by the end of January, as new cases show signs of easing in some states after jumping more than 32-fold within a month. He said there was a "huge boom" in demand in the last quarter of 2021, as millions of weddings took place, prices fell, and higher savings poured into the precious metal as people couldn't travel as much.

Purchases in India usually peak in the October-December quarter, when some of the biggest festivals in the Hindu calendar coincide with the wedding season. The World Gold Council previously estimated that sales in the period last year would be the best in at least a decade.

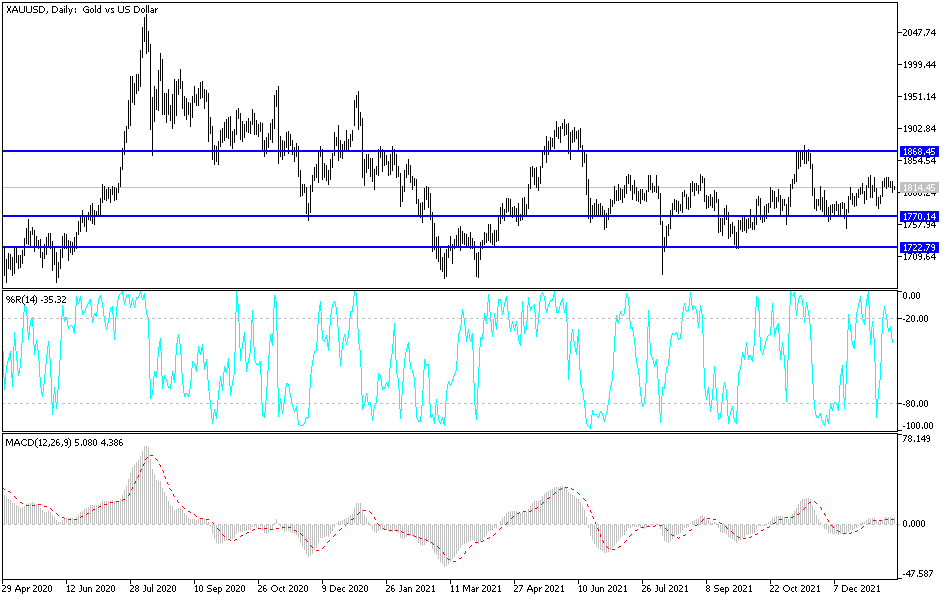

According to gold technical analysis: Despite the recent performance, the price of gold still has an opportunity to rise, as long as it adheres to the psychological resistance level of 1800 dollars an ounce. As I mentioned before, the stability above it will motivate gold investors to think about buying and the closest to them are 1818, 1827 and 1845 dollars, respectively. These are important levels for a stronger control of the bulls' direction on gold. In the event that the price of gold returns to move below the $1800 level, the greatest interest will be to move towards the $1,775 support level per ounce, the most important area for the bears’ stronger control of the trend.

I still prefer buying gold from every bearish level.