The collapse of global stock markets, military tensions between Russia and Ukraine, and skirmishes in the Middle East are factors that supported the price of gold in the upward movement. This is despite the gains of the US dollar from the expectations of raising US interest rates. This environment was enough for gold investors to move prices to the level of 1853 dollars per ounce, its highest in more than two months. Investors are turning to safe-haven assets during a severe downturn. Gold prices are off to a good start in 2022, up 0.9% year-to-date.

In the same way the price of silver, the sister commodity to gold, was courting a top of $24. Silver futures are unchanged at $23.80 an ounce as the price of the white metal is up nearly 2% so far this year.

The leading US stock indexes extended their losses, falling more than 2% in the first part of the trading session. Investors were fleeing stocks as the Federal Reserve raised interest rates, scrapped its pandemic-era quantitative easing program, and slashed its more than $8 trillion balance sheet. The rate-setting Federal Open Market Committee (FOMC) will complete its two-day policy meeting on Wednesday. It is widely expected to provide further guidance on how to navigate the economy and financial markets through a combination of interest rate hikes and balance sheet contraction.

Without this liquidity that the stock market is accustomed to, traders are looking elsewhere, such as value stocks, commodities, and Treasuries.

US Treasury yields were bullish across the board, with the 10-year bond yield rising to 1.749%. One-year bond yields rose to 0.583%, while 30-year yields rose to 2.089%. The rise rate environment is usually bearish for metallic commodities because it raises the opportunity cost of holding non-yielding bullion.

The US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, rose to 96.17, from an opening at 95.92. The index turned positive in 2022, rising 0.2% year-to-date. In general, a stronger profit is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors.

In other metals markets, copper futures rose to $4.4355 a pound. Platinum futures rose to $1025.10 an ounce. Palladium futures rose to $2169.00 an ounce.

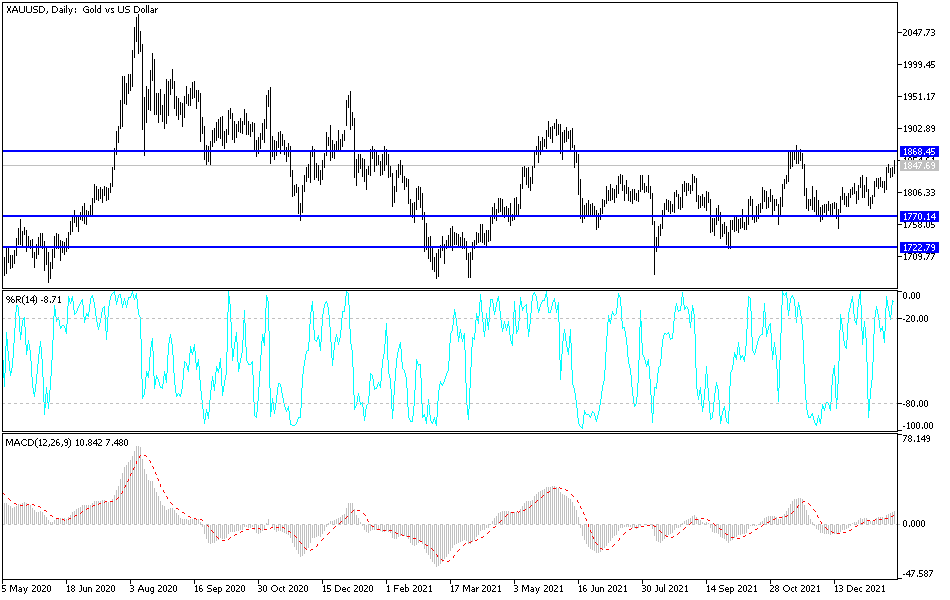

According to the technical analysis of gold: Since the price of gold crossed the psychological resistance of 1800 dollars an ounce, we expected the continuation of the movement. It monitored upward levels, so the price of gold reached all of them successfully, the last of which was the top of 1845 dollars, and it can be found in the technical analyzes of gold. The 1855 dollar top moved some technical indicators towards strong overbought levels, and accordingly, the next bulls' move will be careful so that there are no chances for profit taking sales. The closest targets for the bulls are currently 1862 and 1875, and the last level is important for the next psychological high of 1900 dollars, respectively.

If there are profit-taking sales, especially after the decisions of the US Federal Reserve, the price of gold may collide with the support levels of 1832, 1810 and 1775 dollars, and the last level is important to change the direction of gold to the downside.