For the second day in a row, the price of gold is trying to recover from the losses of the first trading session for the year 2022. The price of an ounce of gold fell to the support level of 1798 dollars, and the recovery reached the level of 1817 dollars per ounce at the time of writing the analysis. On Friday, US jobs numbers will be announced, which will have a strong reaction to the US dollar and to the price of gold.

The US dollar's retreat from high levels helped the yellow metal to rise. The US Dollar Index fell to 96.03 but later recovered to 96.28, posting slight gains.

On the economic news front, activity in the US manufacturing sector grew at a slower rate in December, according to a report by the Institute for Supply Management. Whereas, the ISM said that its manufacturing PMI fell to a reading of 58.7 in December from a reading of 61.1 in November. While a reading above the 50 level still indicates growth in this sector, economists had expected the index to show a more moderate decline to a reading of 60.2. With a larger-than-expected decline, the manufacturing PMI fell to its lowest level since the corresponding reading last January.

Overall, investors have a mix of economic and corporate news to focus on in the first week of the new year 2022 as they try to gauge economic growth with the virus pandemic and ever-increasing inflation. The job market will be a major focus for future investors. Investors are anticipating the US Labor Department's jobs report for December, which will be released on Friday. Yesterday, the agency's monthly job prospects and labor turnover survey showed that 4.5 million American workers quit their jobs in November, in a sign of confidence and more evidence that the US labor market is recovering strongly from last year's coronavirus recession.

Some sectors of the economy are still struggling, especially with supply chain problems. Growth in manufacturing slowed in December to an 11-month low, according to the Institute for Supply Management, a trade group of purchasing managers. The organization will release its December report on the services sector on Thursday.

Investors are also anticipating the minutes of the Federal Reserve's last policy meeting in December, due for release today. The US central bank plans to quickly withdraw its support for markets and the economy in the face of rising inflation. It will speed up the withdrawal of its bond purchases that have helped keep interest rates low, and investors are closely watching the Federal Reserve for any clues about when a US interest rate hike will eventually occur.

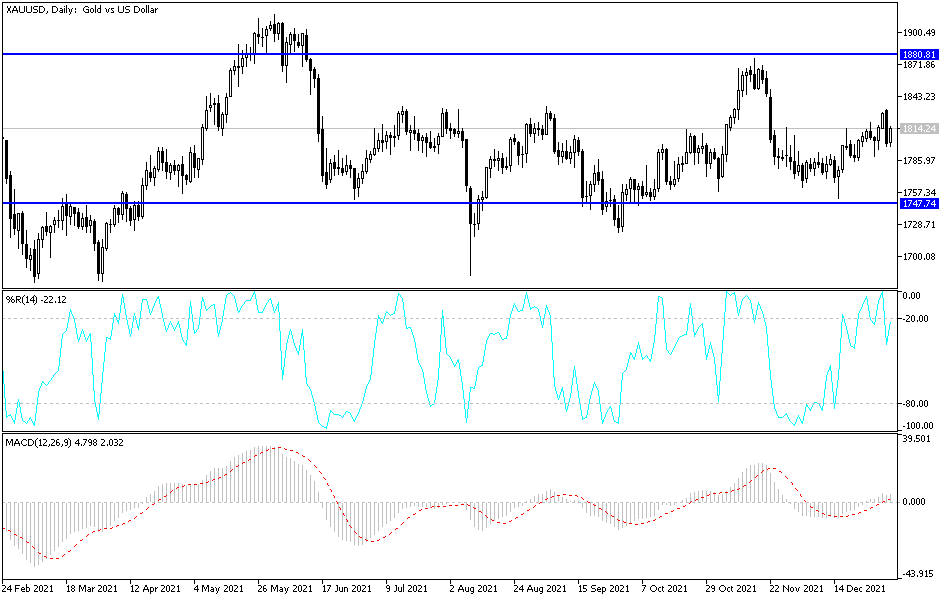

According to gold technical analysis: The price of gold still can rise as long as it is stable around and above the psychological resistance of 1800 dollars an ounce. As I mentioned before, the stability above it will continue to motivate the bulls to move with technical purchases towards the next resistance levels 1818, 1827 and 1845 dollars, respectively. On the downside, the support level of $1,775 will remain the most important for the bears to continue controlling the trend. I still prefer buying gold from every bearish level.