The last trading sessions for the price of an ounce of gold witnessed relative stability in a range between the support level of $1812 and the level of $1823 an ounce. It became stable around the level of $1818 at the time of writing the analysis. The gold market held steady as investors weighed on the prospects for monetary policy tightening and the omicron virus variable threat to the global economic recovery. Global financial markets in general are balancing the future of economic recovery, which is offset by the rapid spread of the new Corona variable.

Billionaire investor Bill Ackman said the Fed is losing its fight against inflation and should raise its key interest rate by 50 basis points more than expected in March to "restore its credibility." Facing pressure from Congress and the public to tackle the hottest inflation since the 1980s, a group of officials this month floated an interest rate hike in March and the likely need for up to five hikes this year, marking an apparent shift in expectations from just a few weeks ago.

As more global central banks seek to normalize monetary policies to contain price pressures, China on Monday cut its key interest rate for the first time since the peak of the epidemic in 2020, as a slump in the property market and recurring virus outbreaks dampened the country's growth outlook. Accordingly, the price of gold settled above $1800 an ounce after dropping for the first time in three years in 2021 as investors started pricing in a tighter monetary policy. However, demand for haven assets remains supported amid concerns about the Omicron impact, with US Surgeon General Vivek Murthy saying the outbreak is likely to worsen and that "a difficult few weeks" lies ahead.

On the economic side official data showed that the world's second largest economy grew 8.1% last year, but activity fell abruptly in the second half as the ruling Communist Party forced China's huge real estate industry to cut spiraling debt. Chinese growth fell to 4% over the previous year in the final three months of the year, bolstering expectations that Beijing may need to cut interest rates or stimulate the economy with more spending on construction of public works. On Monday, the Chinese central bank cut the interest rate on medium-term lending for commercial banks to the lowest level since early 2020, at the start of the Corona virus pandemic.

Continued Chinese economic weakness has potential global repercussions, leading to lower demand for steel, consumer goods and other imports. China has recovered quickly from the epidemic, but activity was weak last year as Beijing tightened controls on borrowing by property developers, leading to a construction slump that supports millions of jobs. This has left consumers worried about spending and investors worried about potential defaults by developers. Consumer spending suffered after authorities responded to the virus outbreak by blocking most access to cities including Tianjin, a port and manufacturing hub near Beijing, and imposing travel restrictions in other regions.

Their "zero COVID" strategy aims to keep the virus out of China by finding and isolating every infected person. This has helped keep the number of cases down, but is limiting consumer activity and causing congestion at some ports.

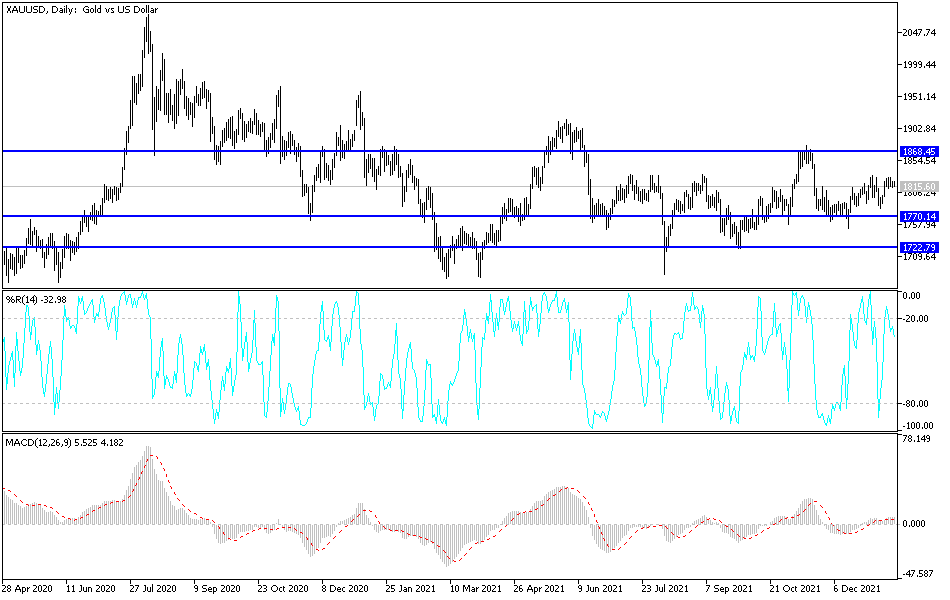

According to the technical analysis of gold: As mentioned before, the stability of the gold price will remain around and above the psychological resistance of 1800 dollars an ounce. It is supporting a stronger control of the bulls and increasing the opportunity for technical purchases, thus moving towards stronger upward levels, the closest to them currently are 1818, 1827 and 1845 dollars, respectively. On the other hand, the support will remain 1775 dollars to confirm the change in the general trend, which is still bullish so far. I still prefer buying gold from every bearish level.