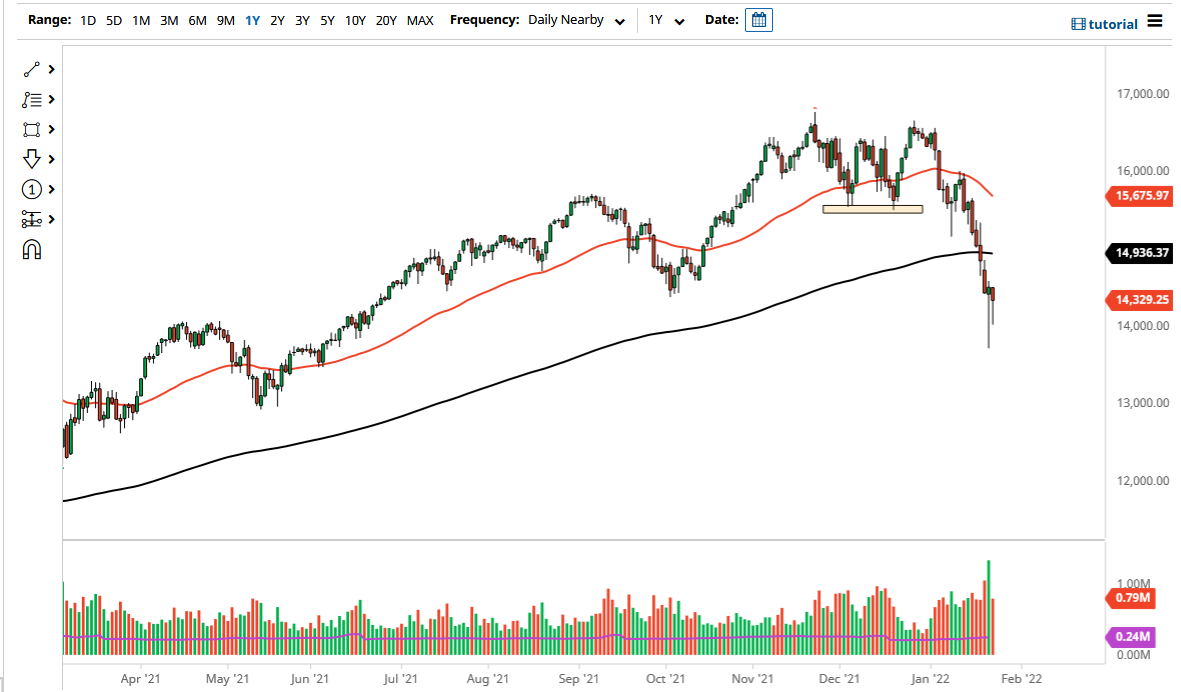

The NASDAQ 100 broke down a bit on Tuesday as we have continued to see a lot of noisy behavior in the markets. That being said, as we close out the day, we are starting to see the market try to reverse a bit, so it will be interesting to see whether or not this hangs on. The FOMC meeting during the Wednesday session is a crucial turn of events for the markets, as we have been selling off mainly based upon Jerome Powell and his seemingly hawkish stance all of a sudden.

That being said, the market is likely to see a lot of issues over the next 24 hours as we try to figure out whether or not the markets will continue to see if liquidity issues are going to continue to be the main fear for traders. Keep in mind that the NASDAQ 100 is highly levered to the technology sector which is very sensitive to interest rates. That being said, the market is likely to see a lot of noisy behavior over the next couple of days, as there has been a lot of concern by traders around the world whether or not the Federal Reserve will continue to save Wall Street by forcing liquidity into the markets.

That being said, the market is likely to continue to freak out if the Federal Reserve sounds extraordinarily hawkish, and that will bring stock markets down over the longer term. In the short term, it is looking very much like it is going to try to rally, but at this point I think it is a bit much to think that the market is going to completely turn around without help from the Federal Reserve, because that has been the main driver of the market for the last 13 years. The question at this point is whether or not that party wil continue. There are a lot of traders out there who have never spent any time in the raising-interest-rate-type of environment, so it will be interesting to see how this plays out. I think at the very least you should keep your position size rather small, as the volatility will make this a very dangerous place to be.