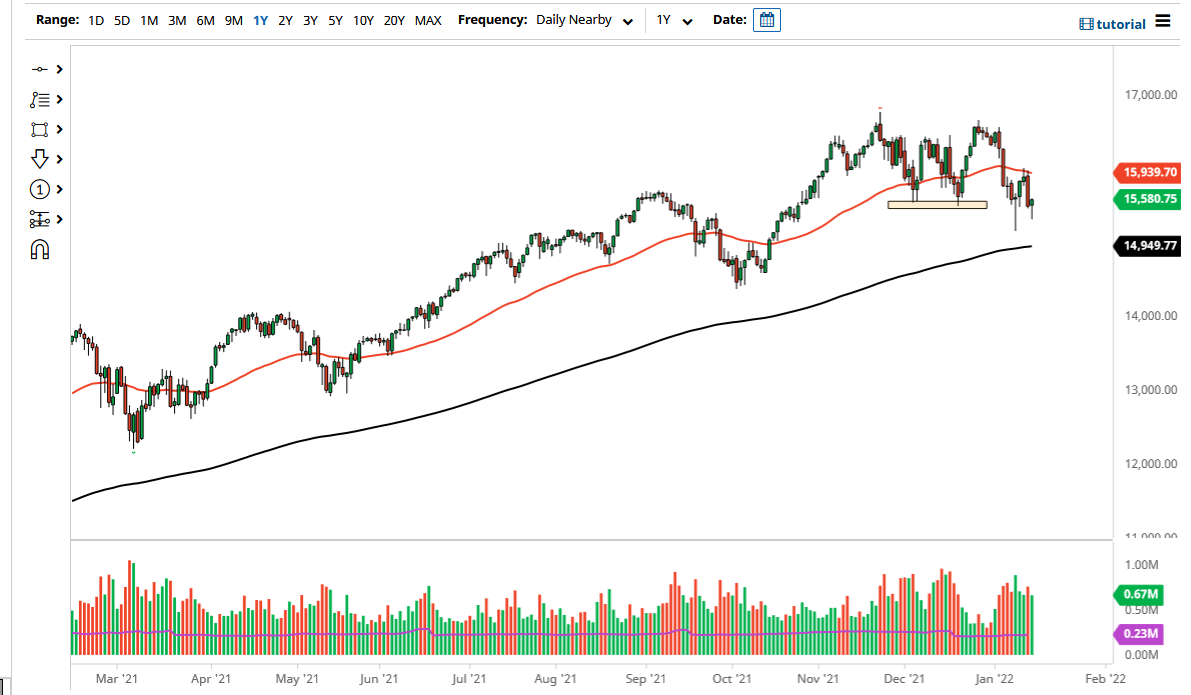

The NASDAQ 100 rallied quite significantly on Friday after initially plunging. It looks as if the 15,500 level is going to continue to offer support based upon the fact that we have formed a nice-looking hammer. With this being the case, I believe it is probably only a matter of time before we see buyers jump back into this market and perhaps go looking towards the 50 day EMA above. I do not believe that this market is going to break down drastically, as we are showing a lot of resilience.

That being said, if we were to break down below the 15,000 level, it would be extraordinarily negative and it would almost certainly scare a lot of traders. At that point, I believe that buying puts might be a good way to go, but I have no interest in shorting this market as it has been so strong during the day, and this is an area that has been extraordinarily bullish due to the previous support. This is not to say that we cannot break down, it just does not look like we are going to anytime soon.

To the upside, the 50 day EMA being broken to the upside is an extraordinarily bullish sign and has this market looking towards the 16,500 level above where we have seen resistance multiple times, so I do think that it is probably only a matter of time before we would hear quite a bit of noise in that area. Breaking above there obviously would have this market going much higher, as it has been so resistant that it would show an explosion to the upside. That being said, I do believe that the NASDAQ could very likely lag behind a lot of its other contemporaries, but I just do not think we are going to break down. Pay attention to the S&P 500, as it could give you a little bit of a “heads up” as to how resilient this market would be. Ultimately, we have seen so much in the way of panic over the last couple of weeks only to see the market stabilize that it tells me there is a lot of underlying pressure to the upside, and although we are rotating the companies that we are seeing strengthen, eventually that comes back to the index level.