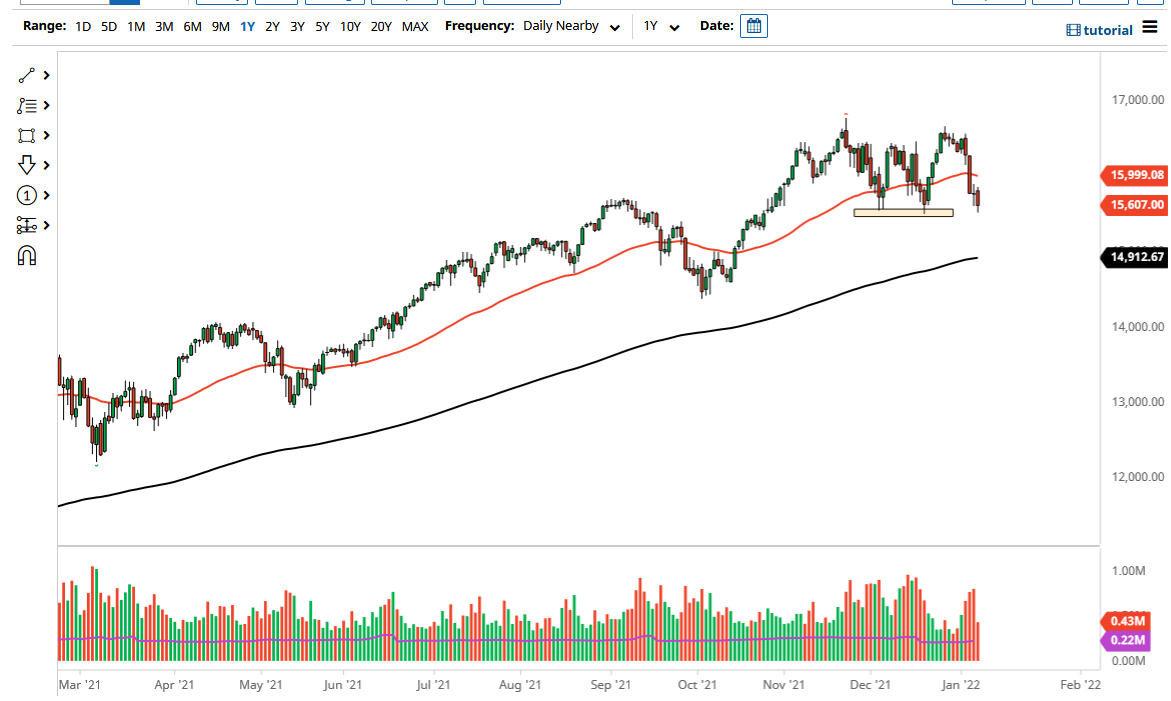

The NASDAQ 100 fell rather hard on Friday as interest rates continue to climb. That being said, the 15,500 level continues to be crucial for the NASDAQ 100, and it did hold during the day. Whether or not it can continue to hold is a completely open question, but it is a level on your charts that you should have marked down as crucial. If we can hold it, then we are due for a bounce in a market that is clearly oversold.

Keep in mind that the NASDAQ 100 and technology stocks in general are very sensitive to interest rates, so if we get interest rates climbing even further, that will continue to put a bit of downward pressure on the NASDAQ 100 itself. You should also keep in mind that the NASDAQ 100 is basically driven by about seven stocks, so keep an eye on the “Wall Street darlings” such as Tesla, Microsoft, and Amazon. Quite frankly, most of the time it does not matter what the other 93 stocks do.

When you look at the chart, you can see that we have been consolidating for some time, and now the question is whether or not this is consolidation before continuation, or is it a rectangle top? I think it is a little early to make that decision one way or the other, but it is clearly what we are trying to figure out. If we were to break down below the 15,500 level, then I think the correction becomes a bit more severe, and I might be convinced to buy puts. I do not short US indices because I recognize that the Federal Reserve or one of its members will say something to pick the market back up, and the last thing you want to do is be on the wrong side of that type of noise.

If we do rally, I suspect that the 16,400 level could be targeted again, but it will probably take a while to get there due to all of the unease that the market has suddenly found. Ultimately, this is a market that I think will continue to be very noisy and Monday should be crucial as far as getting a signal as to which direction we will ultimately go. I do think we are overdone, so expect value hunters come back.