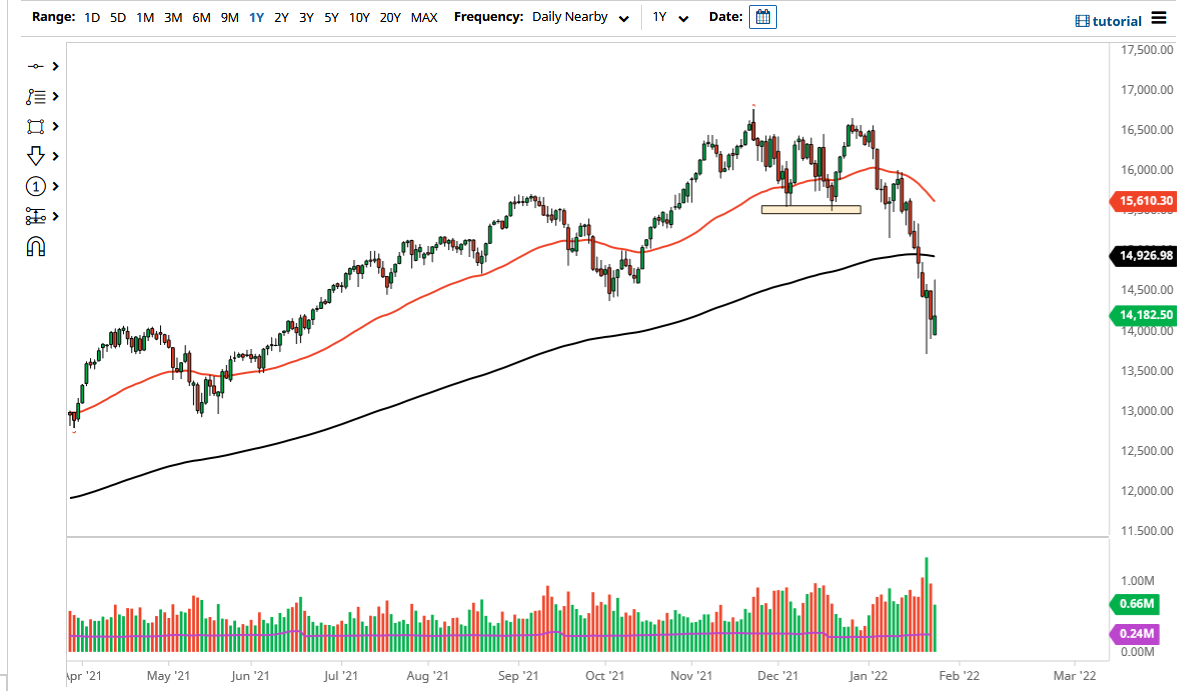

The NASDAQ 100 rallied rather significantly on Monday, giving traders hope that we were going to break out. We reached as high as the 14,600 level before selling off, which happened as the FOMC reiterated its decision that it is going to continue to tighten monetary policy. The monetary policy tightening puts a lot of downward pressure on the high-flying tech stocks, which make up the majority of what we will see move this market.

The shape of the candlestick is certainly nothing to get excited about, but we have not broken down below the hammer from the Monday session, which is the last bastion of support. If we break down below there, I will be buying puts, because if we do break down rather drastically, it is possible that the market will get a certain amount of support in the form of jawboning, but whether or not they do something is completely different.

I think we have not had the “final plunge” that might be necessary for capitulation. Because of this, I think it is only a matter of time before the market sees this, and perhaps people will start coming in on value, but it will be very noisy in general and therefore very dangerous. If you do decide to dip your toe into the water, you need to keep a very small position going, because you are most certainly swimming against the tide. You will probably have plenty of time to get involved to the upside even if we do stabilize.

As we closed, we did see a little bit of “potential bottom picking”, but that is a dangerous way to trade. I think we will continue to see a lot of back and forth, so time is one thing you probably have working for you. Because of this, the market is going to continue to see chop and perhaps some type of consolidation that you can believe in. However, we do not have that quite yet, so you need to be very patient. Longer term, we will eventually see buyers, but at this point this is still very much a bear market that is getting absolutely hammered and will probably continue to do so.