The NASDAQ 100 had a strong move on Monday after initially dipping ever so slightly negative. By doing so, and then attacking the 16,500 level, it looks very much like a market that is trying to build up enough momentum to go higher. Because of this, I do believe that the NASDAQ 100 will more than likely continue to attract a certain amount of attention. For what it is worth, Tesla certainly helped the situation as the stock gained over 10% at one point during the day.

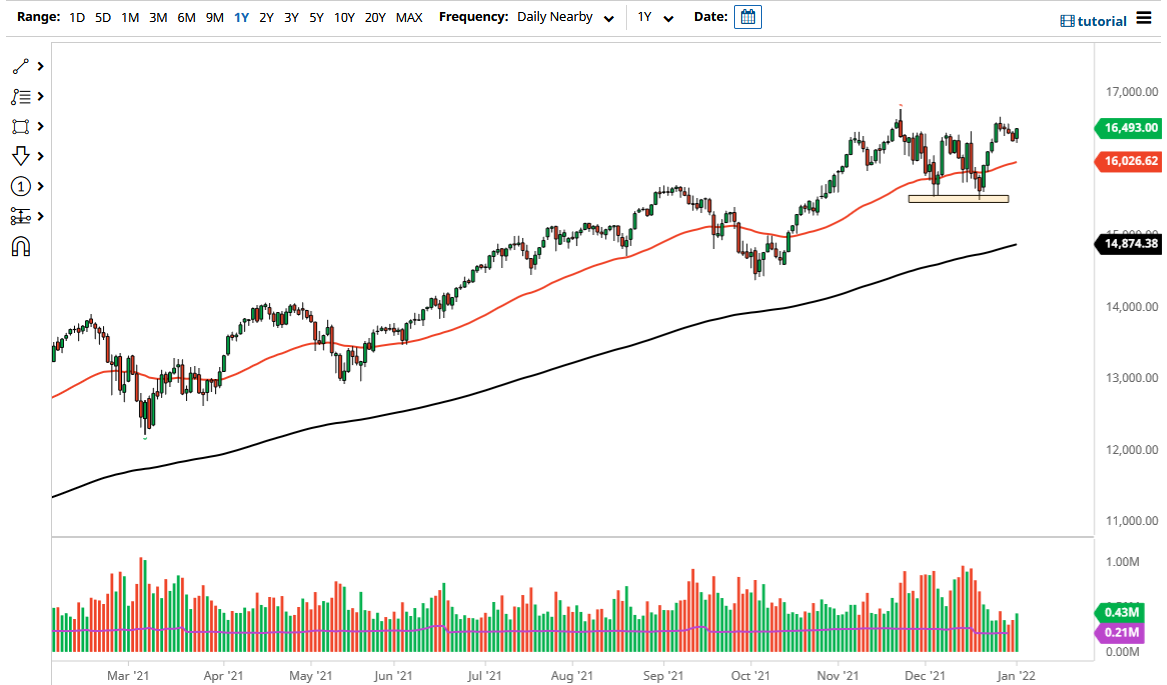

Looking at this chart, you can see that the 50 day EMA is sitting at roughly 16,026, and it looks as if it is starting to arc just a bit higher. Because of this, it should offer a certain amount of support in general as well. Beyond that, we are forming what looks like a bullish flag which could have a measured move as high as 17,700 above. Obviously, that is a longer-term thought, but right now there is nothing on this chart that suggests that it could not happen.

Keep in mind that it is just a handful of stocks that tend to push the NASDAQ 100 higher or lower, so you need to keep an eye on what is going on with Tesla, Microsoft, Alphabet, and handful of other major players. In other words, something like 90 stocks in this index do not really matter much, as it is not an equally weighted situation. Because of this, you should think of this more or less as a growth index, as most of these companies have the idea of growth in common. With that being said, I believe it is probably only a matter of time before we see any dip bought into, because quite frankly everybody is chasing some type of return.

Furthermore, as we have just started the new year, there will be quite a few traders out there looking to add risk to their books for the year, in order to start working on this year’s returns for clients. In other words, a lot of big money is forced into the market at this point in time. Granted, Friday is the jobs number and that will have its say, but ultimately, we need to pay attention to the upside here.