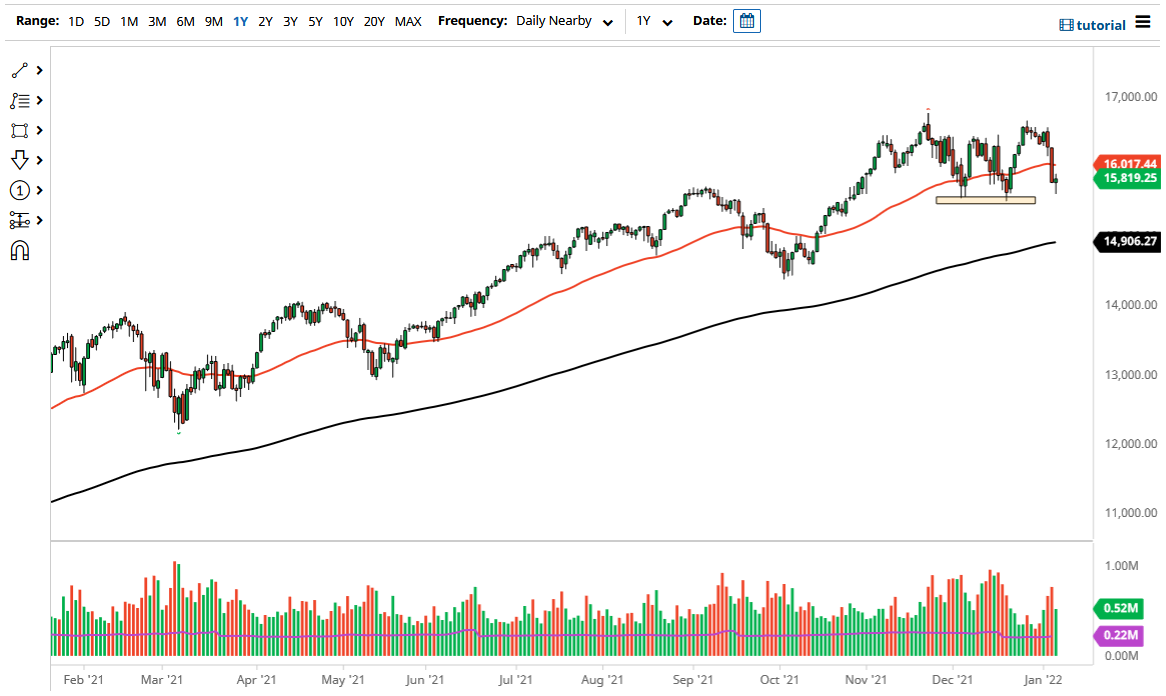

The NASDAQ has fallen significantly during the trading session on Thursday, but then turned around to show signs of support at the 15,600 level, an area that has been important more than once as of late. That being said, the market is currently consolidating overall and therefore I think is probably only a matter of time before we see buyers jump back in. The resulting candlestick is a hammer, which of course is a candlestick that a lot of people will pay close attention to. Ultimately, if we can break above the top of the candlestick for Thursday, it is technically a bullish sign.

The 50 day EMA sits at the 16,016 level, and I think makes a nice short-term target. The NASDAQ 100 is of course sold off at the moment and has showed itself to be a little overdone. All things been equal, this is a market that I think will continue to see a lot of sideways action, as we have continued to see the uptrend play out. The Federal Reserve suggesting for interest-rate hikes over the next year of course has freaked out the market and has most certainly worked against the value of the technology stocks attend to push this market to the upside. All things been equal, I do think that we rally a bit and I think we will eventually go looking towards the 16,500 level above.

If we were to turn around a break down below the 15,500 level, that could change a lot of things that we could go looking towards the 200 day EMA at the 14,900 level in general and should continue to be an area that a lot of people will pay close attention to. Regardless, we have been going higher over the longer term, and I think that we will continue to be the case given enough time. We have the jobs number coming out on Friday and that of course can have a major influence on the US dollar, which by extension can have a significant influence on what happens in the stock markets overall. Regardless, I do not have any interest in shorting this market, but I do recognize that if we were to break down below the 15,500 level, then it is possible that I could be a buyer of puts.