The NASDAQ 100 has gone back and forth during the trading session on Thursday as we continue to see a lot of noisy behavior, and therefore what we would consider to be unstable. With this being the case, I think the 14,000 level will continue to be important, and therefore it offers a little bit of a magnet for price. Because of this, I would anticipate more choppy behavior, but as the general feeling of risk behavior starts to drop off, it makes certain amount of sense that technology stocks will get crushed.

Keep in mind that the NASDAQ 100 is pushed around by just about 7 or 10 stocks, so as long as the “Wall Street darlings” continue to get hammered, that is going to weigh upon this index. However, people jumping back in the markets to pick up Tesla, Microsoft, and Google would be reason enough for this market to rally. Quite frankly, it does not look very healthy, so I think it is probably only a matter of time before we go looking to lower levels. That is not to say we cannot get some type of short-term rally, just that I would not be an aggressive buyer.

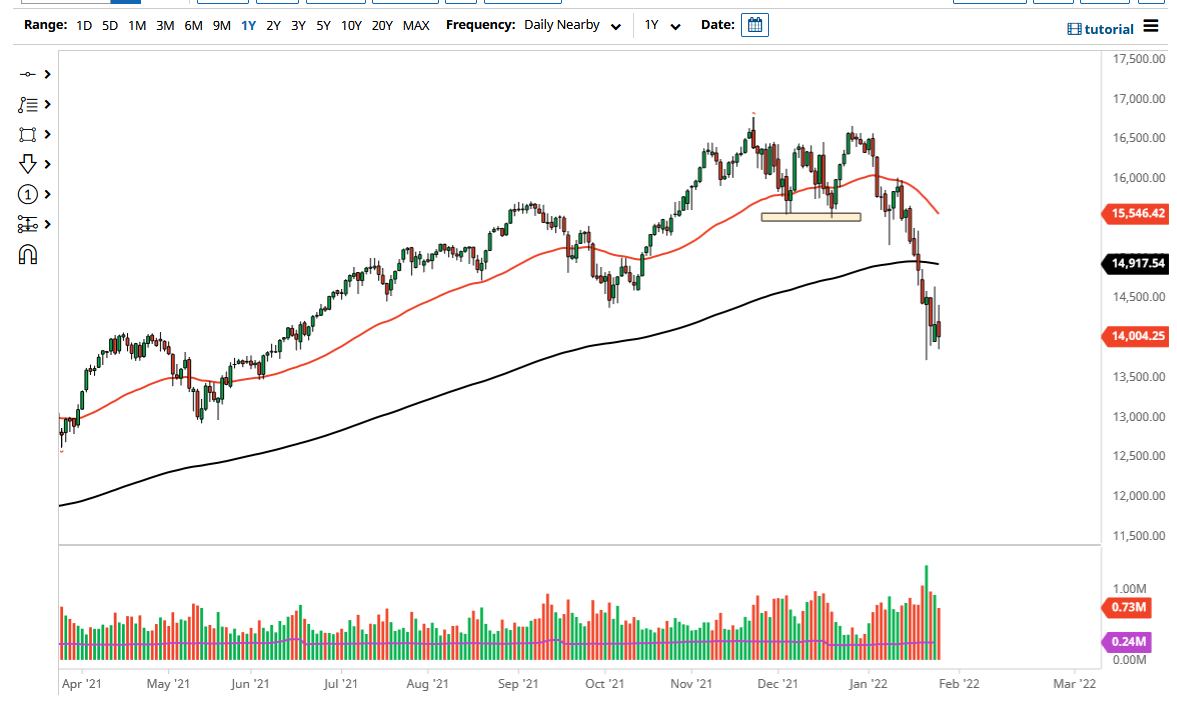

The 200 day EMA currently sits at the 14,917 level and is currently lower, and therefore you would have to think of it as a bit of a barrier. It is starting to curl just a little bit lower, but I think given enough time that resistance will come into the picture and cause a bit of an issue. Ultimately, I do like the idea of shorting signs of exhaustion if we get them or shorting a break down below the bottom of the range overall if we get it. Because of this, I think that the market will eventually give us an opportunity to push this market towards the 13,500 level, and below. I have no interest in buying the NASDAQ 100 in the short term, because I think there is far too much risk out there to make it an appealing trade. Pay attention to the risk appetite in general, that will give you a bit of a “heads up” as to where the NASDAQ 100 is likely to go. We have sold off so drastically that a bounce is probably coming, but that will be faded.