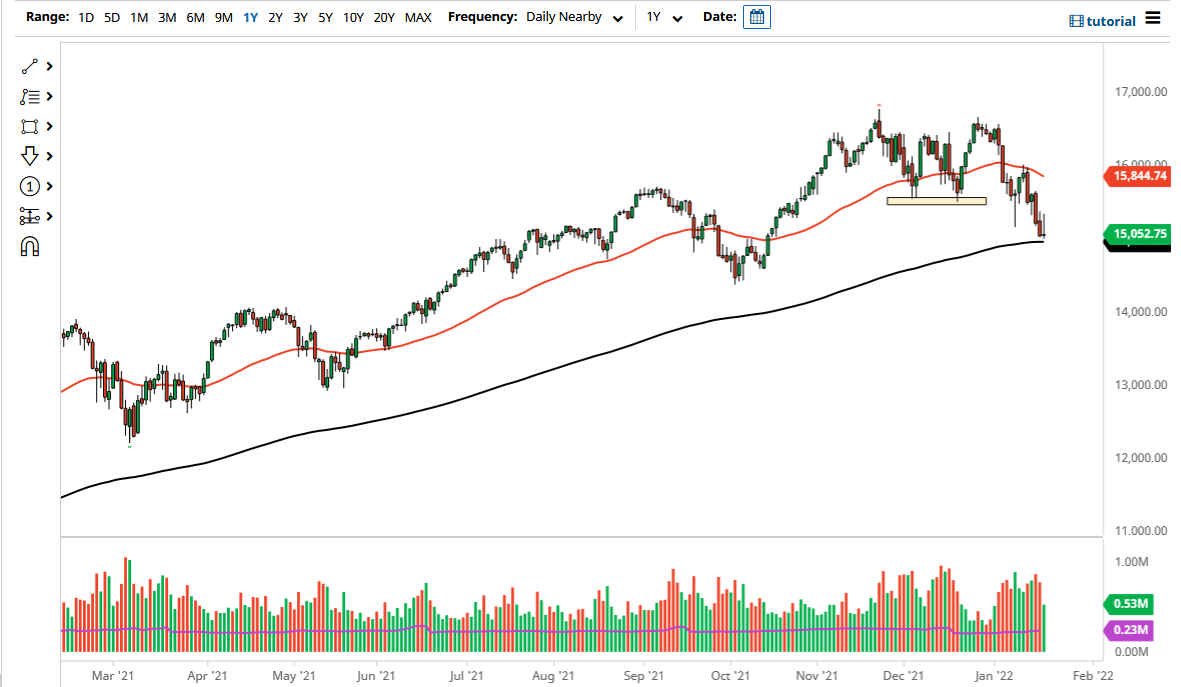

The NASDAQ 100 has tried to rally during the trading session on Thursday but gave back the gains rather quickly. The NASDAQ 100 just simply cannot seem to get its act together. With this being the case and of course concerns about the Federal Reserve tightening into a slowdown, a lot of the so-called “highflyers” that make up the overall attitude of the stock market in this index are going to get pummeled. It is the high multiple stocks that are paying the biggest price, and that of course will drag this index down right along with it.

It is worth noting that we have formed a bit of an inverted hammer, sitting right on top of the 200 day EMA. In other words, it will attract a lot of attention. If we can hold this area, that would be a good sign but quite frankly we are threatening the 15,000 level at the end of the session, and it looks like we are probably going to plunge even further. At this point, it is very likely that we will continue to see downward pressure on any short-term rally, because quite frankly this looks horrible. It would not surprise me at all to see another 10% chopped off of the NASDAQ 100, but I do not sell US indices under any circumstance. The Federal Reserve will come in and do whatever they can to lift things.

I will buy puts though and if we break down below the 200 day EMA, I think it is a reasonable place to start looking. That being said, please pay attention to the fact that it is options expiration on Friday, so we probably get more noise than usual in an environment that is a bit of a mess. Ultimately, if we break above the top of this candlestick, it would be a good sign but it is really not until we recapture the 15,500 level that I would be impressed enough to put money to work. I think we have a lot of work to do in the short term to stabilize things, but this is not a very impressive candlestick from what I have seen, and I suspect that we will continue to see a lot of negativity. Inflation is too high in the United States, the Federal Reserve is about the tightening into what is going to be a slowdown cycle, and there is not a lot of faith in the direction the country is going at the moment.