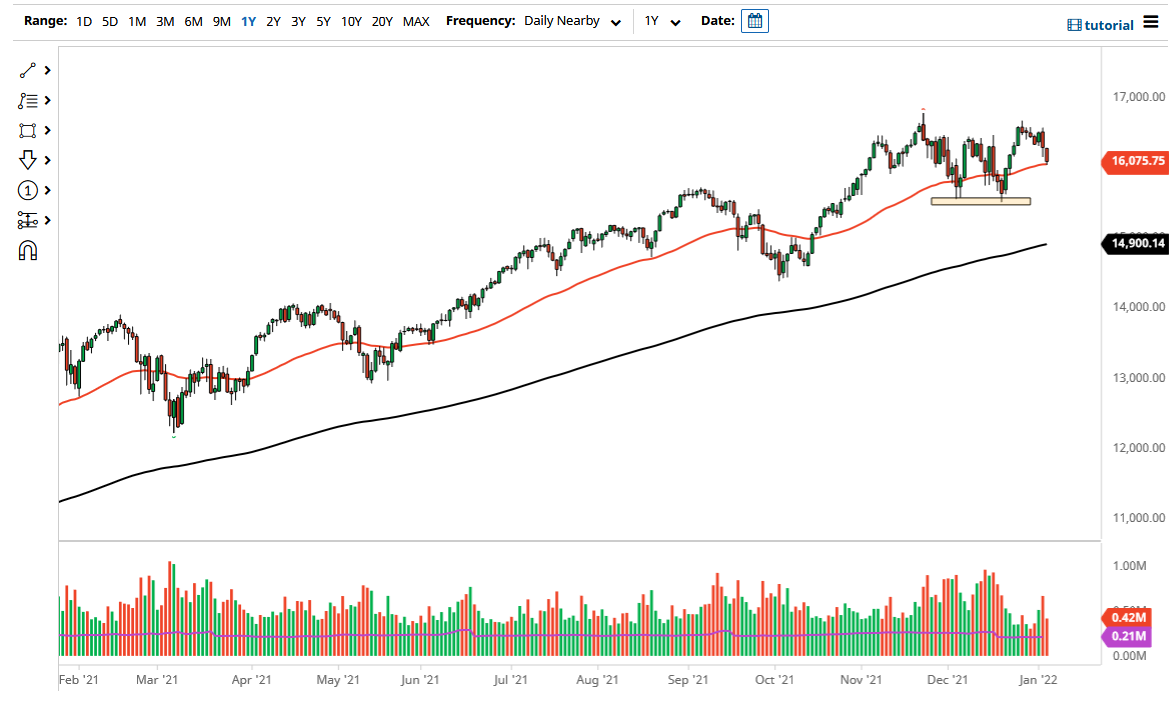

The NASDAQ 100 fell rather hard on Wednesday again, as it looks like the market simply cannot quite find its footing. A lot of this comes down to the fact that yields are starting to rise, which is an absolute killer for technology stocks over the longer term. Whether or not that sticks is a completely different situation, but it clearly looks as if the market is trying to pull back to some type of supportive area. Because of this, I think it is probably only a matter of time before buyers jump back in, and they certainly do not think that the market is anywhere near turning into a bearish market. In fact, it is not until we break down below the 15,500 level that I would even consider this market in trouble.

The market has found the 50 day EMA to at least be interesting, so I will be interested to see how this plays out. I think given enough time we will see a recovery, but it may take a little bit to make that happen. Ultimately, this is a market that has been in a significant uptrend for quite some time, and despite the fact that we have seen such a selloff over the last 48 hours, that has clearly not changed.

The market will more than likely find some type of footing one way or another, if for no other reason than the fact that the 10-year yield is reaching the top of the range that it has been in, and it is probably only a matter of time before that starts to fall again. Once that happens, then growth stocks that make up the large portion of the NASDAQ 100 will become much more attractive for traders, and therefore likely to recover quite nicely.

If we did break down below the 15,500 level, I might be interested in buying puts, but I certainly would not be a seller of this market because the market is so bullish from a longer-term standpoint. This is especially true considering that the overall attitude of this market does tend to be explosive at times, but has the occasional pullback like we are sitting right now. This is a market that I think will eventually go looking towards the 17,000 level.