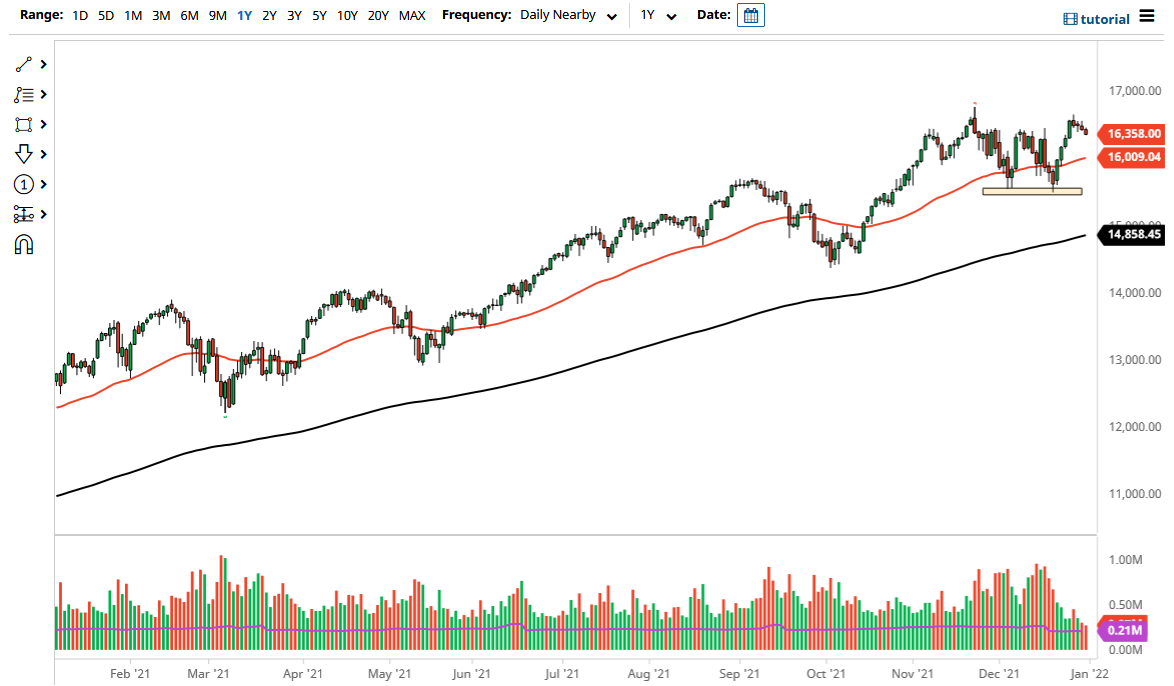

The NASDAQ 100 drifted a little bit lower on Friday to reach down towards the 16,385 level. Keep in mind that this was the previous resistance barrier that the market struggled with so much in the past, so now that we are sitting here one would have to think there should be a certain amount of support in this area just waiting to test the market. Furthermore, you have to keep in mind that it was New Year’s Eve, so the market did not even run a full session and there was a certain lack of liquidity at that point.

The 50 day EMA sits just above the 16,000 level and is rising so I think eventually that will come into the picture and offer a little bit of dynamic support. Keep in mind that the market has been in a very bullish run for quite some time, so there is no reason to think that we would change tactics all of the sudden. You can even make an argument that we have formed a little bit of a bullish flag, although I think that is probably a little bit misleading. Nonetheless, the market pulling back should give you plenty of opportunities to pick up a little bit of value.

Keep in mind that the NASDAQ 100 is not equally weighted, so there is only a handful of stocks you need to pay close attention to. Think of companies like Tesla, Microsoft, and of course Google. Those “Wall Street darlings” will continue to drive the market more than anything else and it really does not matter what most of the stocks in this index do. At this point, it is simply a matter of finding little bits and pieces of value that you can buy into, and I think that there will be enough people coming back to work next week that they will have to buy the NASDAQ 100 in order to add some alpha to their empty books that they closed out the year on. The first week or two of January tends to be positive in general, and I just do not see that changing here due to the fact that people will be looking to build up positions for 2022.