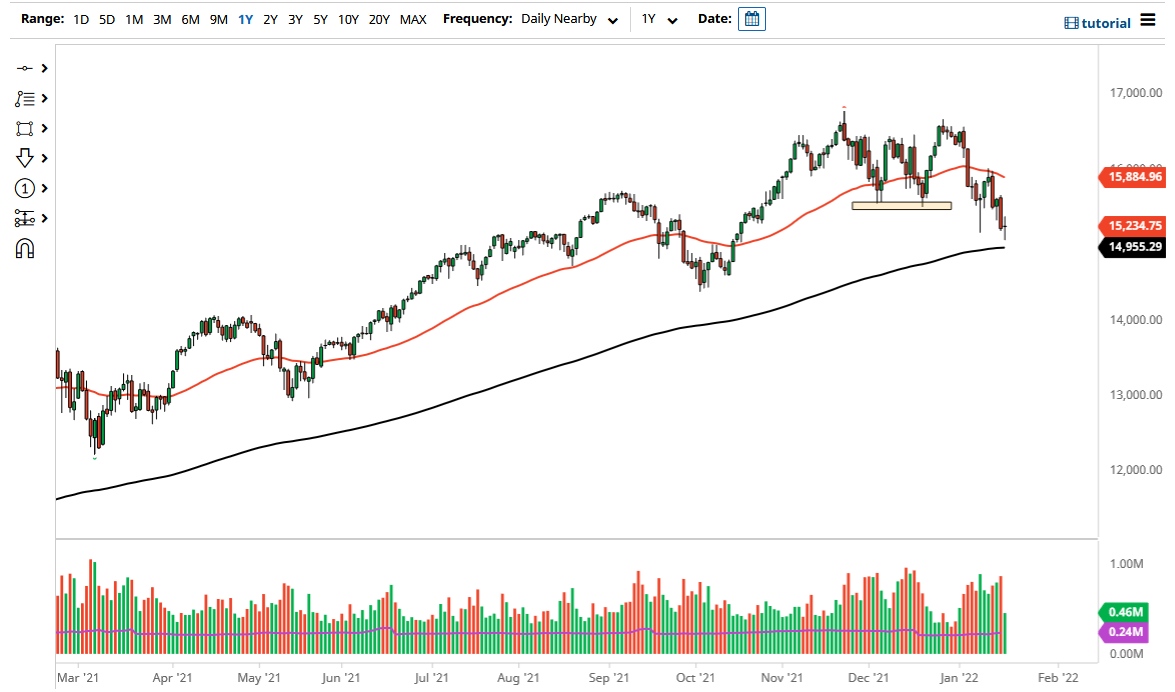

The NASDAQ 100 was very volatile on Wednesday as we continue to hear a lot of noise overall. That being said, it is worth noting that the 200 day EMA so far has kept the market somewhat supported, and we are forming what has to be thought of as a potentially neutral candlestick. That being said, the market will pay close attention to that 200 day EMA which currently sits at the 14,954 level.

The 200 day EMA will of course offer a lot of psychological and perhaps even structural support, but it is also going to be an area where I would expect to hear a lot of noise. Ultimately, if we can break above the top of the candlestick for the day, I think that would be a good sign and we could go looking towards the 15,500 level which had been important support previously. This is an area where we could see sellers come back in, but if we break above there then I think the market will save itself and go higher in more of an uptrend. That being said, we would have a lot of work to do in order to make that happen. In fact, we would need to see the bond market settle down in order for that to happen as well, as a lot of the large technology companies get dumped in that scenario.

If we do break down below the 200 day EMA, we could see a new rush of selling, but at this point in time I do not see that being very likely. At least not in the short term, that is. If we do break down below that area though, I would be a buyer of puts, as you would probably send this market much lower, but it is only a matter of time before the Federal Reserve would stick their nose into the marketplace. I believe we are trying to find some type of support and I will be watching very closely to see if the market can in fact cause a bit of a bounce. If it does not, then we may have to revisit the 14,500 level over the longer term. Regardless, keep your position size small so that you do not wipe yourself out.