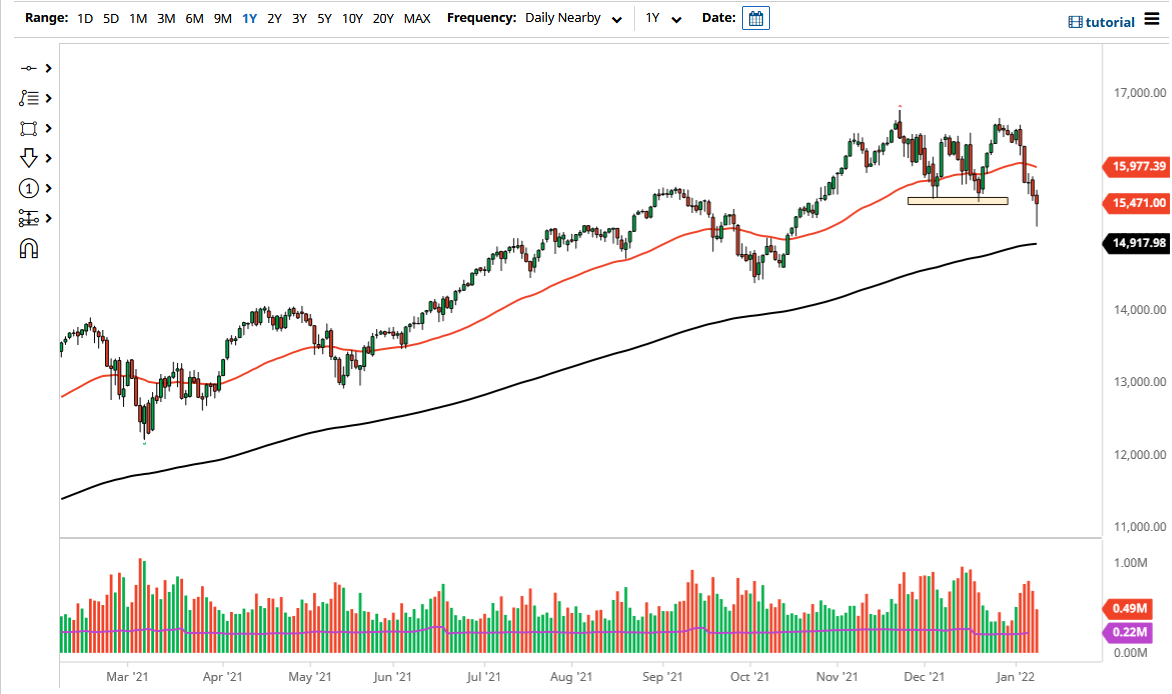

The NASDAQ 100 has fallen significantly during the course of the trading session on Monday to reach down towards the 15,150 area only to find buyers underneath to turn around and form a massive hammer. The hammer of course is a bullish sign, and it does suggest that perhaps we have buyers underneath willing to pick this market up, especially as we got relatively close to the 200 day EMA. With this being the case, the market breaking above the top of the candlestick is a classic technical analysis signal to get long.

If we did break out above the top of the candlestick for the Friday session, that could send this market right back into the consolidation area that we had been in previously, meaning that the 16,500 level could be targeted. All things being equal, this is a market that continues to see a lot of noisy behavior but all things being equal it is likely that we are going to see a bit of a recovery because quite frankly we have gotten a bit oversold. Furthermore, that 200 day EMA underneath will probably cause a bit of support as well.

If we were to break down below the bottom of the hammer, then it is likely that we would test the 200 day EMA rather quickly and breaking down below that would kick off a lot of algorithmic trading, and perhaps forced liquidation. Remember, most large funds are leveraged these days, and therefore if things go south, they really go south quickly. However, at this point in time it looks as if buyers are willing to step in and defend this market, especially as companies like Apple turned around. Speaking of which, there is only a handful of companies out there that make this index move, so therefore we need to pay close attention to the large tech stocks such as Apple, Tesla, Microsoft, and the like. All things been equal, this is a market that I think continues to see a lot of volatility, but we may have found the bottom during the Monday session, at least for the time being. I have no interest in shorting US indices anyway, but in this particular case in the way that we behaved on Monday afternoon tells me that you certainly should not be a seller of this market.