The NASDAQ 100 fell significantly yet again on Monday but saw enough buying pressure late in the day to turn things around and form a massive hammer. Is this the end of the massive selling? Probably not. However, it is worth noting that the Wednesday session is going to be crucial as we have an FOMC meeting that a lot of people are going to be paying close attention to for signs of either hawkish or dovish behavior from the Fed. Perhaps people on Wall Street believe that since we have seen such a devastating sell off, Jerome Powell will come to save the day. This makes sense, as that is exactly what has happened for the last 13 years.

That being said, inflation is a situation that Wall Street is not used to. Over 40% of fund managers have never traded money in a money tightening cycle, so this obviously is something that could come into play. I think a lot of this will probably come down to the idea of not knowing what happens next, and that of course can cause a lot of problems. It is very likely going to be a situation in which Tuesday might see more short covering, but the “rubber meets the road” on Wednesday, as whether or not the Federal Reserve is going to be hawkish or dovish is probably going to be the biggest mover in general.

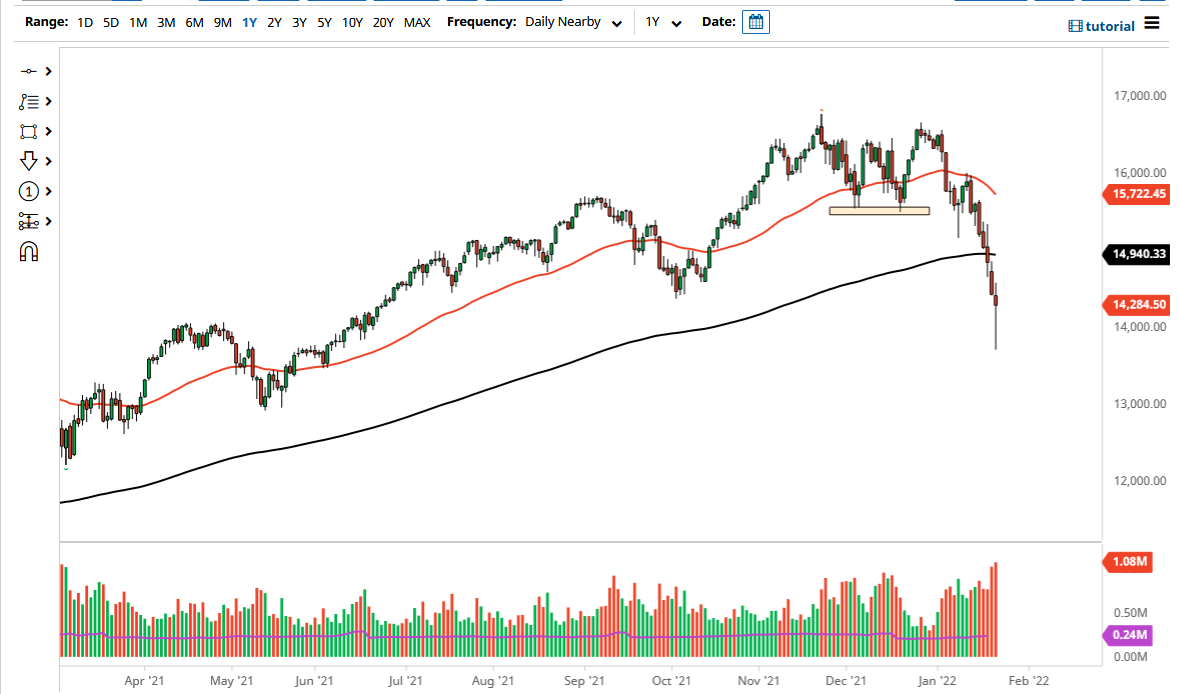

At this point in time, the NASDAQ 100 will certainly see a bit of resistance at the 200 day EMA, sitting at the 14,942 level. Beyond that, then you have the 15,000 level above. That is a large, round, psychologically significant figure, and I do think it will be interesting to see how the market behaves near that area. The market continues to see a lot of volatility, and typically that is a bad thing. Because of this, I believe that you will have a better opportunity to buy the NASDAQ 100, unless Jerome Powell changes his overall tone and decides that the Federal Reserve needs to be a little less hawkish. The next couple of days will be very noisy, but by the end of the day on Wednesday, we should have more clarity.