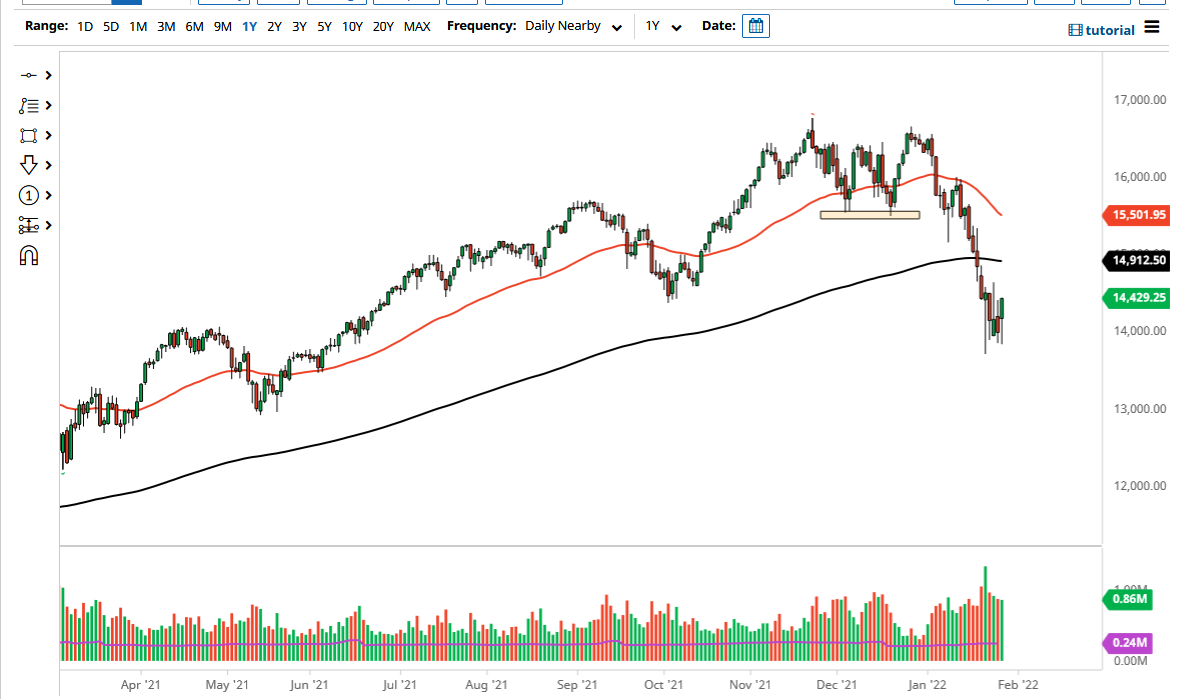

The NASDAQ 100 dropped a bit on Friday to test the bottom of the overall consolidation range. However, we have turned around to show signs of strength and we are closing the week at the top of the recent consolidation area, meaning that at the end of the day we have stayed in the same 500-point range or so.

If we can break above the highs of the week, then it is likely that we could go looking towards the 200 day EMA which is at 14,912, possibly even the 15,000 level. I do believe that the 15,000 level will be significant, and it is not until we break above there that I would be interested in buying, because there are a lot of things working against technology stocks right now and stocks in general as the Federal Reserve is tightening monetary policy. That has a major “risk off” feel to it, and as a result we will need to see that overall attitude of the markets change. At this point, it certainly does not look as if that is going to be the case anytime soon, so I think that rallies will end up being a nice selling opportunity.

I will be looking for signs of exhaustion after moves higher, because all of the pundits are talking about whether or not the markets are ready to turn around. Unfortunately, we are in a much different scenario than we have been in the last 13 years, and I do think it would take very little to spook the market. This is not to say that we cannot bounce about 50%, but the growth in GDP continues to decelerate, which is something that the market will try to price in going forward. Whether or not we have positive earnings going forward is not the question. The question is whether or not the earnings will keep coming in the way they have. Now that we have this market trying to make a little bit of a move to the upside, I think if you are patient enough you should get a nice opportunity. On the other hand, if we break down below the lows of the week, that opens up a bit of a trapdoor to much lower levels, possibly 13,000.