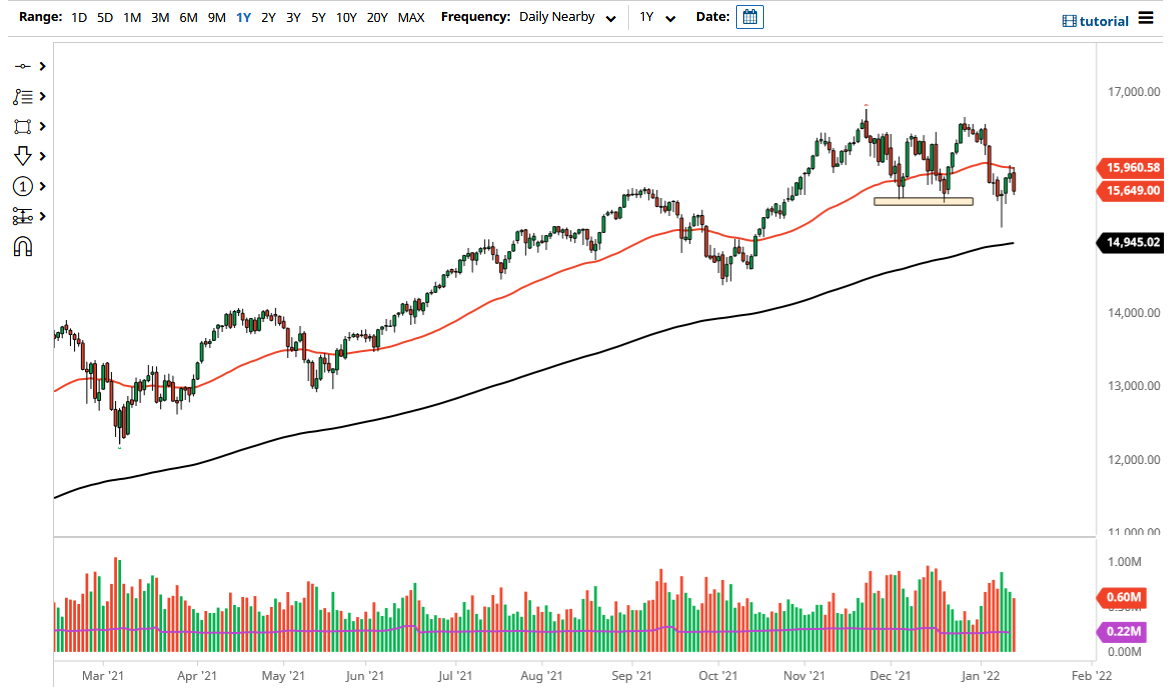

The NASDAQ 100 has been hammered during the trading session on Thursday to pull back from the 50 day EMA. The market is likely to look at this area as a potential support level, as we had formed a hammer here during the Monday session and of course the 15,500 level is an area that has been supportive multiple times. Because of this, I am paying close attention to this index, but I also am a bit hesitant to get overly bullish.

This is going to be a very difficult market to trade, as we are at a significant level on the longer-term charts, and if we can break down below the bottom of the hammer from the trading session on Monday, I think we could see more of a selloff. What if I short this market? Absolutely not. I could buy puts, but at this point in time that is about as bearish as I would get. Ultimately, this is a market that I think will continue to see a lot of noise just below, but it certainly has not done itself any favors during the trading session on Thursday. This sets up for a very dangerous Friday session, so at this point in time we absolutely will have to turn things around or things could get ugly rather quickly.

I suspect that you are probably better off waiting to see what happens during the Friday session instead of trying to rush into the marketplace. That being said, if we can turn around and take out the 50 day EMA to the upside, it is very likely that we could see this market go much higher, perhaps reaching towards the recent resistance barrier near the 16,500 level or so. As per usual, you need to keep an eye on some of the highflyers such as Tesla, Microsoft, and Google. The NASDAQ 100 simply cannot rally without those stocks doing well, and therefore you should think of this more as an ETF and less of an index. I do believe that given enough time, we will make a bigger decision, but Friday is going to be very dangerous and therefore I will be placing any trades until I see what the weekly candlestick ends up looking like. With this, caution is urged.