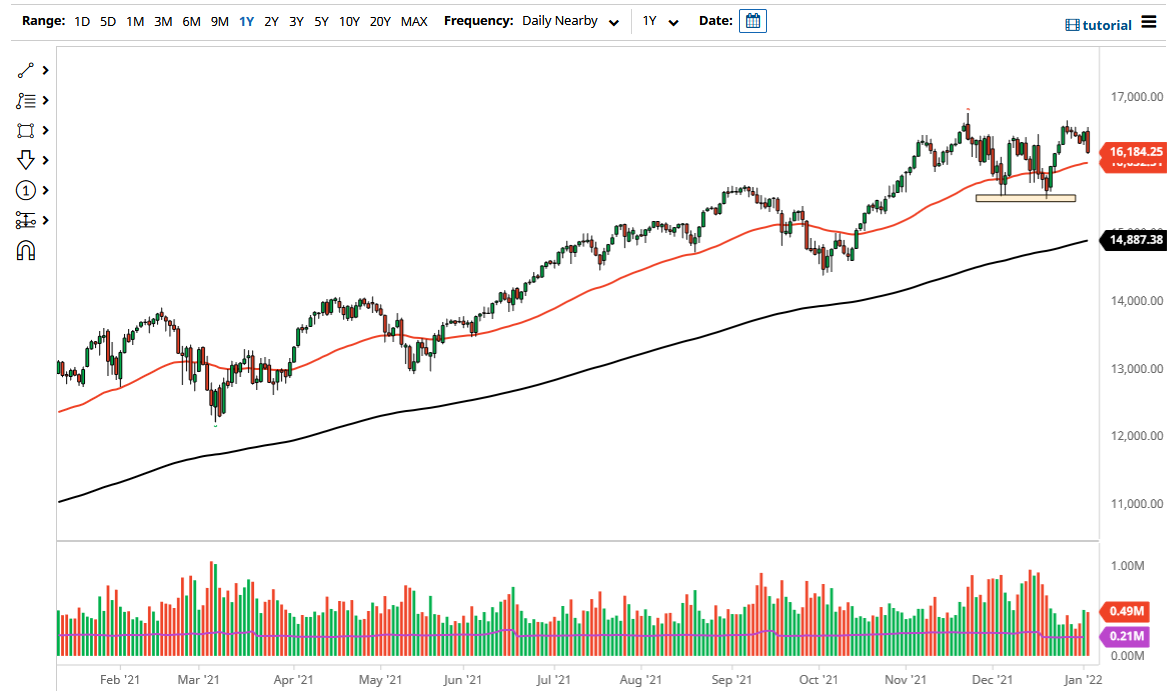

The NASDAQ 100 broke down rather significantly on Tuesday, losing almost 2%. The market is closing towards the very bottom of the candlestick, which is a very negative sign and does suggest that perhaps we might have a little bit of follow-through. Nonetheless, we are still very much in an uptrend, so you have to keep that in mind.

A pullback at this point make quite a bit of sense, and now it will be interesting to see how the 50 day EMA comes into the picture, as it could offer the support that a lot of people will be looking for. Regardless, stocks are not something that I plan on shorting anytime soon, but we obviously have a lot of noise when it comes to the overall attitude of markets, and I think any dip will be thought of as an opportunity. The size of the candlestick is somewhat impressive, but longer term, it is more likely that we will continue to see plenty of value hunters looking to get involved on any type of significant pullback.

It should be noted that interest rates rising during the day worked against technology stocks in general, so it does make sense that we had seen a pullback, and all of the volatility that is going on with Tesla at this moment does not help the situation. Nonetheless, I do believe that somewhere between now and the end of the week we should see a turnaround situation where we could pick up quite a bit of momentum. On the other hand, if we turn around and take out this candlestick it is very likely that we could go looking towards the highs again, and perhaps even the 17,000 level after that.

Either way, the 15,500 level underneath is what I consider to be the “floor in the market”, so it is likely that we will continue to see that area as “the bottom.” As long as we stay above there, there is no reason to suggest that the market should be sold. If we do break down below there, then I might be a buyer of puts, but that is about it when it comes to shorting this marketplace or any other US index for that matter.