The S&P 500 initially dipped during the trading session on Tuesday, but it has become clear that buyers are stepping back into pick this market out, especially after Jerome Powell has spoken front of Congress Tuesday. Ultimately, we have the CPI print coming out on Wednesday but at the end of the day it looks like the overall accommodative policy that the Federal Reserve has been stuck in is most likely the outcome going forward. Every time this market has pulled back, there have been buyers over the last 13 years.

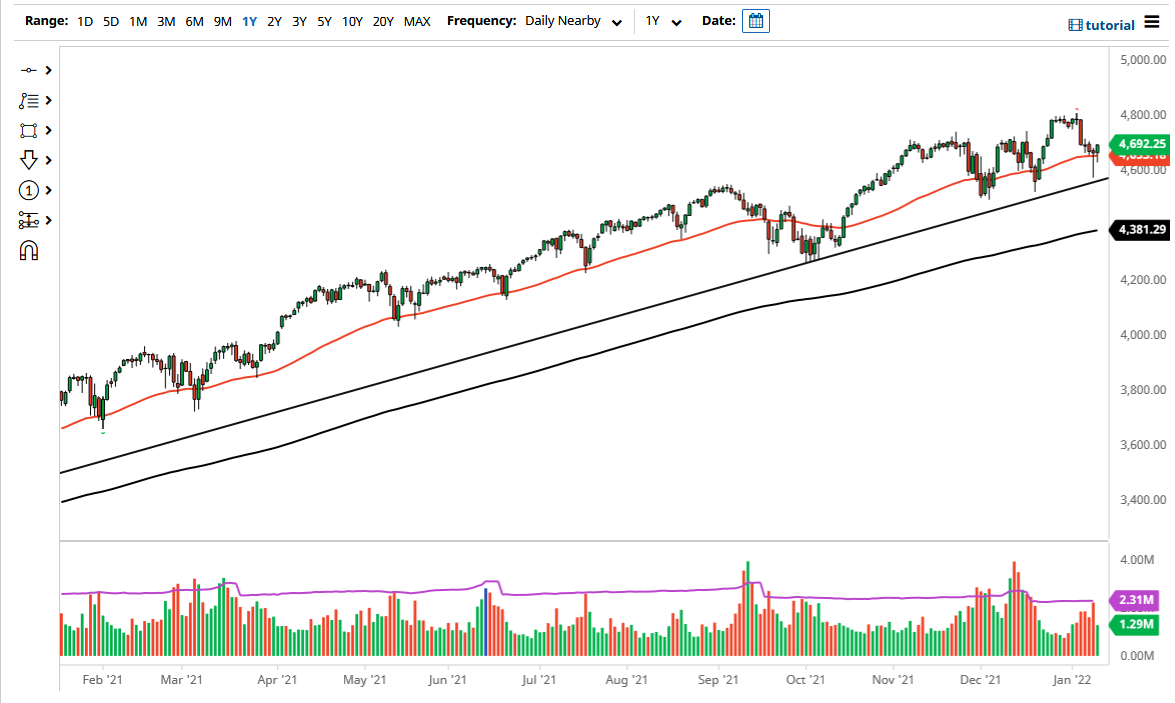

The 50 day EMA offering a bit of support is a technical signal of course, and the fact that we formed a nice-looking hammer during the previous session suggests that we could see plenty of support in this area and I do think that it is probably only a matter of time before the buyers come in and take over. If we can break above the 4700 level, that would be yet another hurdle to overcome, and would almost certainly send this market back towards the highs over the longer term. All things been equal, there is no way you can short this market, especially considering that we have seen such a turnaround over the last couple of days. Furthermore, there is a nice uptrend line sitting underneath that could continue to offer support as well.

Underneath, we have the 4500 level, which is an area that I think is significant support and will continue to look at that as the “floor in the market”, that a lot of people will be buying into. With that being the case, if we were to break down below that level then I might be a buyer of puts but I do not anticipate that we would challenge it anytime soon. I believe that given enough time this is a market that will continue to find reasons to go higher based upon the narrative, and of course the fact that Jerome Powell was not nearly as hawkish as a lot of people were concerned about heading in front of the Senate. That being said, you also have to keep an eye on those CPI figures, but I think the market already recognizes that a seven handle is more likely than not, so it probably will not be much of a shock.