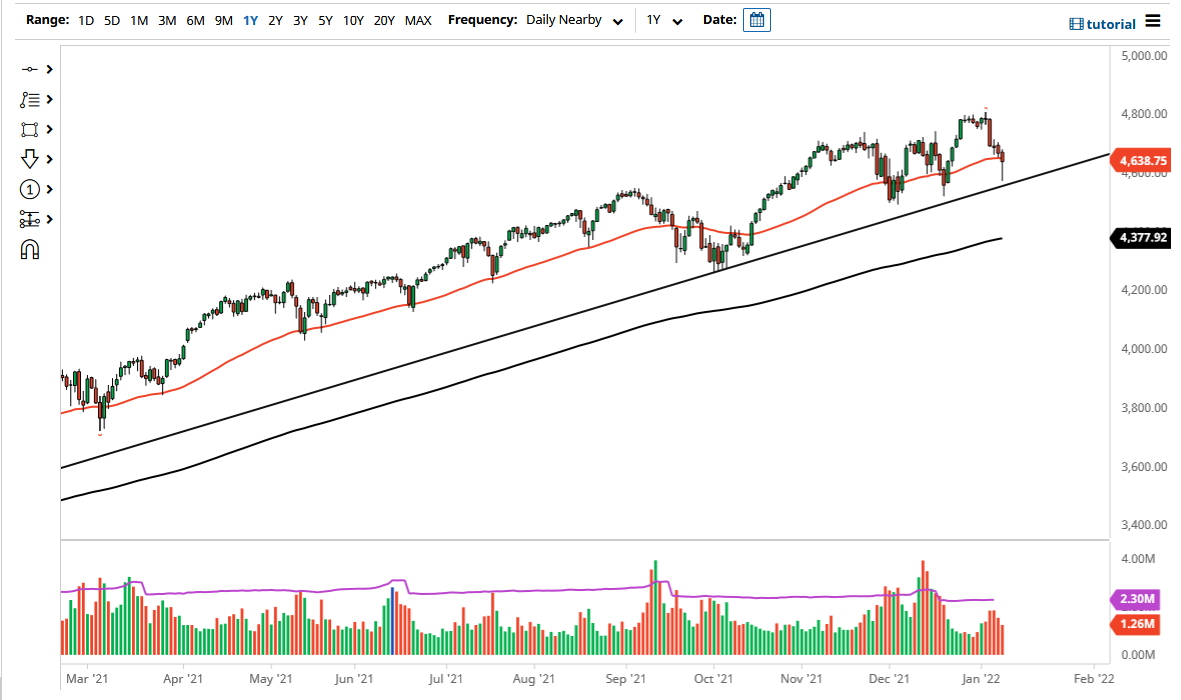

The S&P 500 fell significantly during the course of the trading session on Monday to reach down towards a major uptrend line and pierce the 4600 level. However, we have turned around to form a nice-looking hammer for the trading session and it looks as if we are ready to go higher again. After all, we have been in an uptrend for quite some time, if we can break above the top of the hammer that it is likely that we could go looking towards the 4800 level above.

At this point, if we were to break down below the bottom of the hammer for the trading session, I think we go looking towards the 4500 level, which of course is a large, round, psychologically significant figure and an area that I think a lot of support comes back into the picture as well. If we were to break down below that level, then it is very likely that we would be very bearish, and at that point in time I would be a buyer of puts but I would not short this market because if it gets out of hand, the Federal Reserve almost certainly will step in. The last 13 years to see the Federal Reserve do that multiple times, so that being said it is very likely that we will continue to see Jerome Powell do what he can to save Wall Street.

If we break above the top of the candlestick, then it is very likely that we go looking towards the 4800 level above, which has been like a “brick wall” for the market. If we can clear that, then I do think that the S&P 500 continues to go higher, perhaps reaching towards the 5000 level. The 50 day EMA is currently slicing through the candlestick for the trading session as well, so I think that may have kicked off a little bit of algorithmic or technical trading, but at the end of the day the S&P 500 continues to see some resiliency in this general vicinity underneath is, so therefore I think we do have a good shot at recovering. Rates of course have spook the market, but at the end of the day I do not think this is the end of the world, because quite frankly a lot of Wall Street does not believe that the Federal Reserve is going to raise interest rates four times this year.