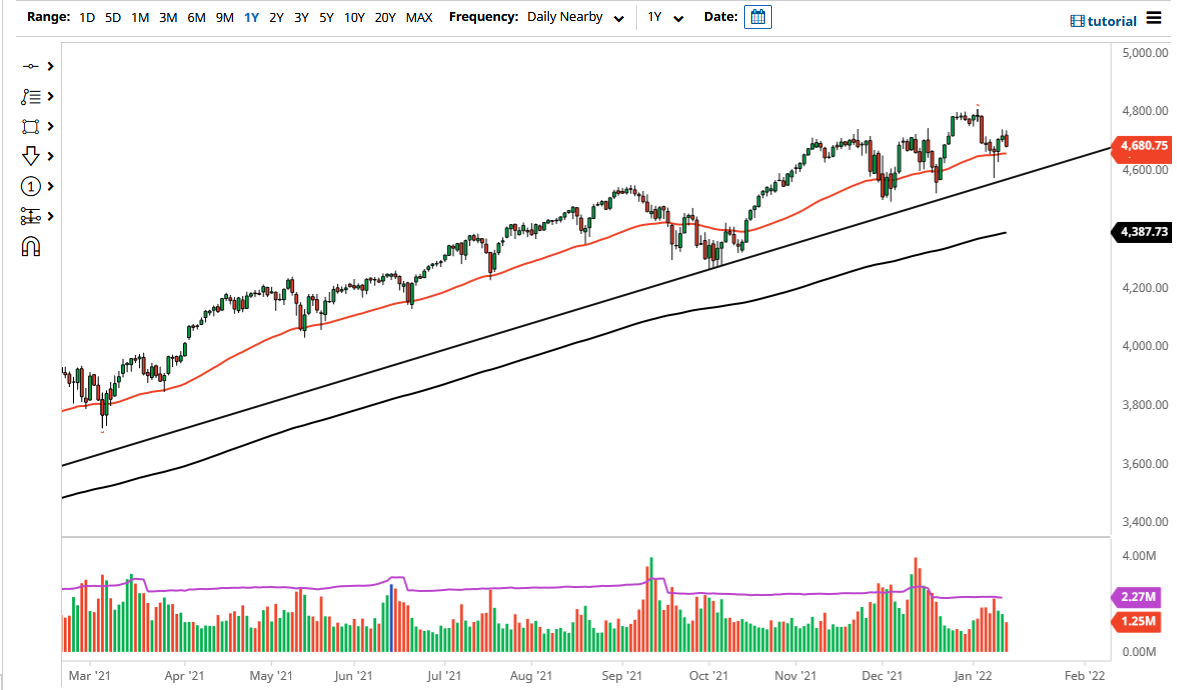

The S&P 500 initially tried to rally during the trading session on Thursday but then broke down rather significantly. What is somewhat concerning is that we are closing towards the very bottom of the range, and that does suggest that perhaps we could see this market continue to fall. The 50 day EMA of course is that the 4677 handle, and a certain amount of interest will be paid to that level as it is a widely followed technical analysis indicator.

Beyond that, we also have the hammer from the Monday session that sits right around the 50 day EMA, so it does make a certain amount of sense that we would see a lot of interest in this area. Ultimately, this is a market that I think does have plenty of support underneath, but it is difficult to get overly aggressive on Friday as I think we have to make quite a few decisions in this general vicinity. While the S&P 500 itself does not look to poor, it is worth noting that the NASDAQ 100 looks horrible. Because of this, we could see a general selloff, but it may not be as bad here as it is in other places.

To the upside, that we have a micro double top at the 4733 handle that has formed over the last couple of days. With that being the case, I do not think that we are likely to see much in the way of an attempt to break out above there in the short term, but over the next couple of days we may get back to that area. If we do, and more importantly break above that then it allows the market to go looking towards the 4800 level above which has been like a brick wall for the market. If we were to break above there, it would obviously be a very bullish sign, but right now I just do not see it happening very easily. This will be especially true as people continue to worry about the Federal Reserve tightening monetary policy. With this, I expect a bit of a pullback, but I do not necessarily expect a major breakdown. I am paying close attention to the 4600 level underneath, because if we break down there then it is possible that I might be a buyer of puts but that is about as negative as it would get.