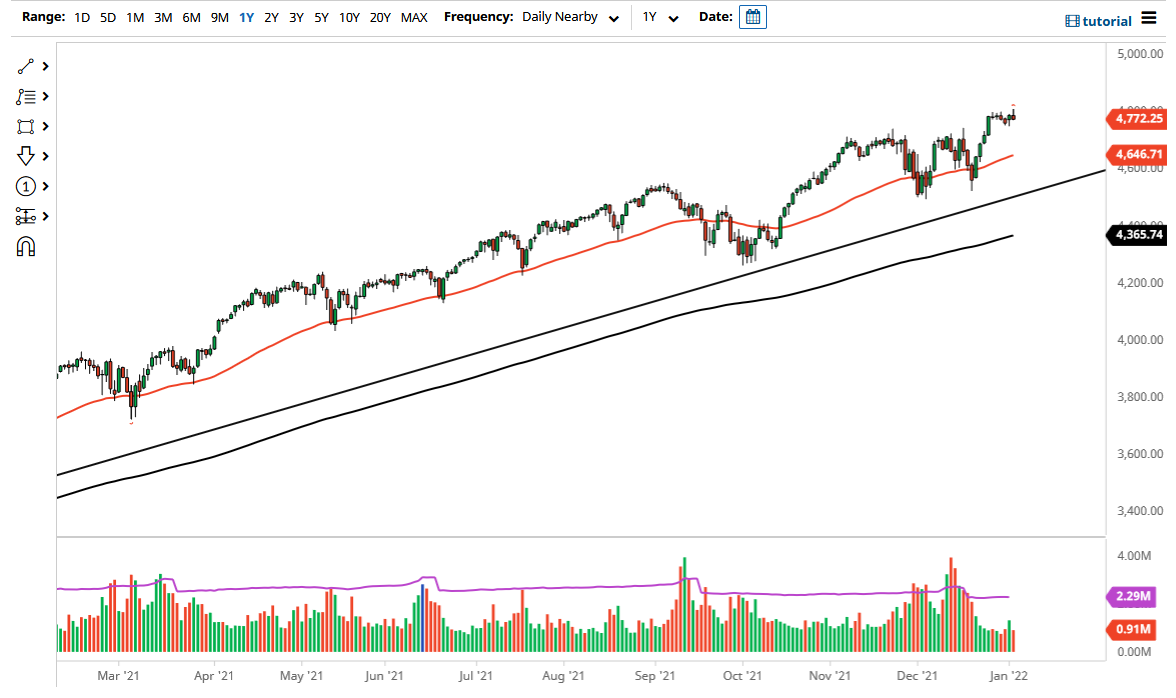

The S&P 500 rallied on Tuesday to reach towards the 4800 level, but as you can see, we have turned around and fallen as we continue to struggle for footing. That should not be a huge surprise though, because this is the first week of the year and we need to get a little bit of clarity before we put a lot of money to work. The jobs number on Friday will have its influence as well, so this should be relatively straightforward at this point.

Dips at this point should continue to be buying opportunities, but I also believe that there is significant support underneath at multiple areas, especially near the 50-day EMA underneath. I currently sits at the 4646 level and is rising, suggesting that we have plenty of buyers on dips and plenty of value hunters out there waiting to happen. The market has been in an uptrend for quite some time, and it does make sense that we would see plenty of pressure underneath continue to lift this market.

The S&P 500, like other US indices, is clearly a situation where you can only trade in one direction, as the Federal Reserve will pick this market up every time it falls for any significant amount of distance. Therefore, I think that short-term pullbacks will be bought into as plenty of value hunters will continue to look at this through the prism of “the Federal Reserve will do what it takes.” Yes, we are talking about tapering from the Federal Reserve, but they will never do anything close to actually cutting their balance sheet, as quite frankly the markets cannot take it. Yes, they have paid lip service recently, but at the end of the day, we are stuck in a pattern where the Federal Reserve is essentially painted into a corner.

The 4500 level underneath should continue to be massive support, based upon not only psychology of the big figure, but the fact that we have seen a bit of a bounce from there more than once. There is a trend line underneath there, so there are plenty of technical reasons to think that we will find buyers.