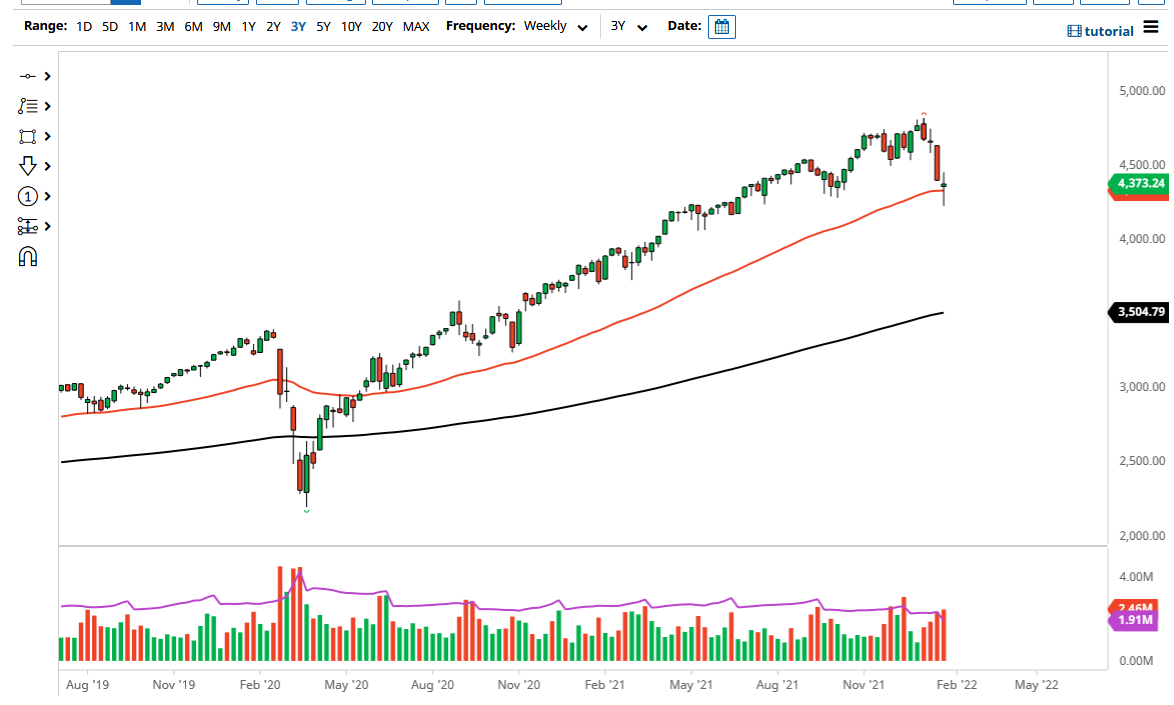

As of this writing, we are seeing the S&P 500 try to stabilize itself near the 50-week EMA and/or the 4200 level. That being said, the market is likely to see a bit of a short-term relief rally, but at the end of the day the Federal Reserve is going to be tightening monetary policy, whether or not Wall Street likes it. After all, this is a market that has been feeding on liquidity over the last 13 years, and it will act upon whether or not it is getting cheap cash.

That being said, this is not a market that you shouldy try to short, because it is only a matter of time before the Federal Reserve will do something to bail these jokers out. But at the end of the day, it has a while to go before people feel that much pain. We have only lost 500 points, so you need to be very cautious about trying to “pick a bottom” at this point in time. Yes, the weekly candlestick does show signs of a short-term rally, but any time we see signs of exhaustion I think a lot of sellers will jump back in. After all, a lot of people are looking to protect wealth, and with the Federal Reserve tightening monetary policy you will see interest rates going higher. If that is going to be the case, then it is very likely that a lot of people will be concerned about the economy slowing down.

Short-term pain is the idea so that inflation does not grab a hold in a more permanent sense. However, the Federal Reserve has a long history of “getting it wrong”, historically speaking. After all, they do tend to tighten into slowing cycles, and there is an argument to be made that the rate of change when it comes to inflation has already peaked, and it is likely that we would see the idea of the Federal Reserve tightening only slow things down even more drastically. They have done it before, and it looks like they are doing it again as they typically react a little bit too late, so it is almost guaranteed that eventually they will have to reverse. Once that happens, the stock market will celebrate. That will not be happening in February though.