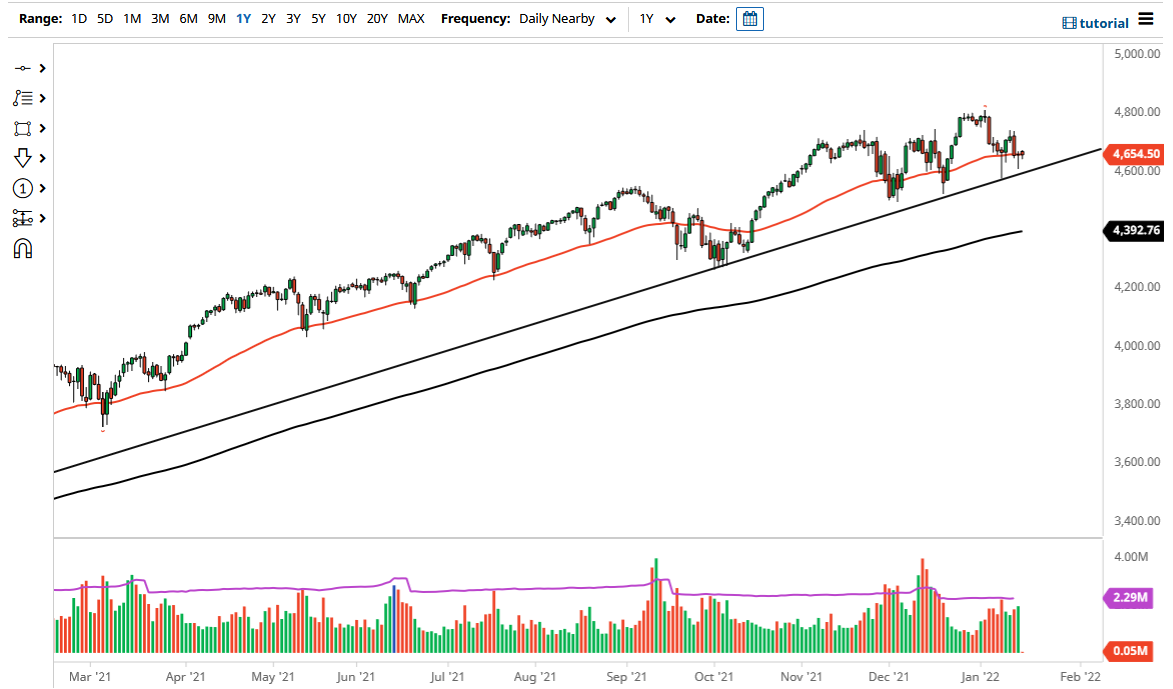

The S&P 500 futures dipped ever so slightly on Monday as it was a holiday, so of course liquidity would be a major issue. With that being Martin Luther King, Jr. Day in America, the index itself was not moving, so the futures market was more or less going to be more of a bounce around. That being said, we are sitting at the 50 day EMA, so it does make sense that we would see this market hang around.

If we can break above the highs of the Friday session, then I think the market is likely to go looking towards the 4725 handle. With this, I think that we will probably see buyers jump into the market on Tuesday when Wall Street comes back to work, but that does not necessarily mean that it has to happen. I think this is a market that will probably see a lot of noise and concern, but at this point in time one has to think that the concerns of the Federal Reserve tightening are already out there, so it is difficult to imagine that the market would suddenly selloff in some type of shock movement. With this being the case, I think what we have here is a situation where Wall Street has absorbed a lot of the “fear” and the price now is trying to form a little bit of a double bottom in order to go higher.

Keep in mind that there was some serious trouble at the 4736 handle, so that is obviously going to be the first target. If we can break above that little area, then it is likely that we will go much higher, perhaps reaching towards the 4800 level. The 4800 level is an area that will attract a lot of attention not only due to the fact that it was a large, round, psychologically significant figure, but also the fact that we have seen a lot of selling pressure there, so it makes a bit of a target for a market that is trying to break out. It will have to fight that level in order to get higher and continue the overall uptrend.