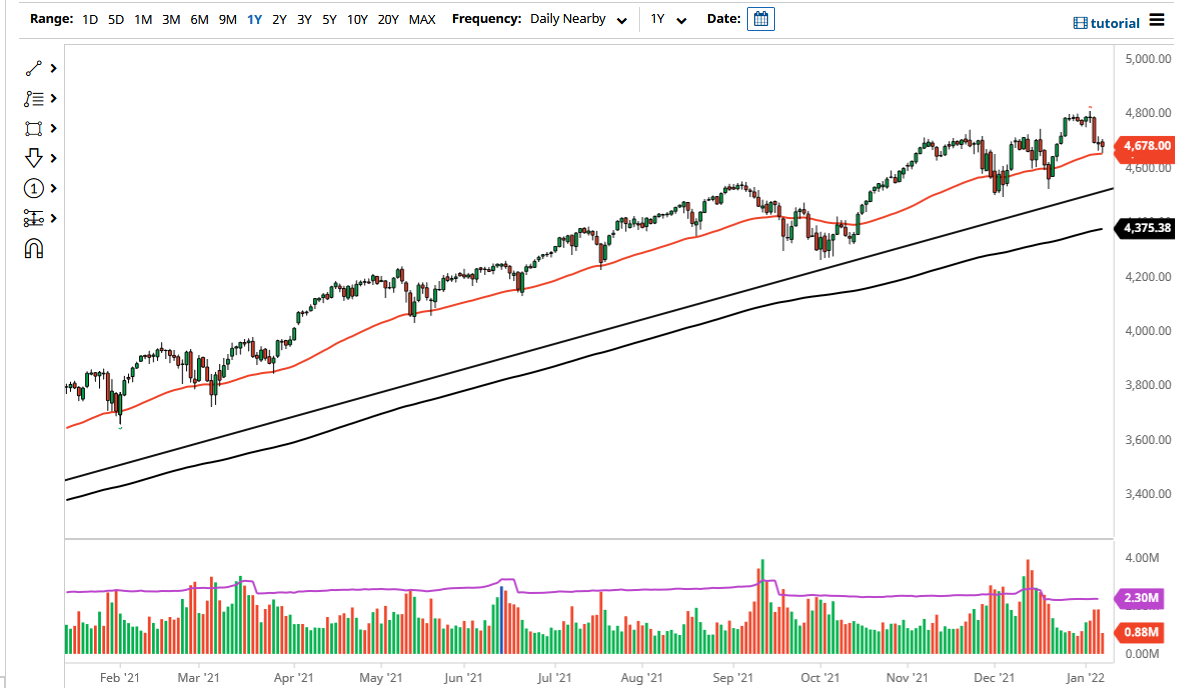

The S&P 500 initially fell on on Friday in reaction to the jobs number being so poor. The United States added 199,000 jobs for the month of December, much less than the 400,000+ that was anticipated. Because of this, stocks got hit again early in the day but it appears that the 50 day EMA continues to offer a significant amount of technical support, as it has for several months and years. Ultimately, this is a market that looks as if it is trying to find a little bit of support in this general vicinity, perhaps coming to terms with the idea that the Federal Reserve is not going to completely obliterate the stock market.

That being said, I believe that this is a market that will continue to try to find buyers on dips, as the 4650 level also has offered a little bit of psychological support. Because of this, I think it is probably only a matter of time before we see buyers coming into pick up value. After all, stock markets will continue to enjoy an ultra-loose Federal Reserve, which is light years away from tightening.

Furthermore, there is the possibility that some on Wall Street are starting to price in the idea that the Federal Reserve cannot tighten as much as they are claiming, if employment is in fact going to be that poor. It will be an interesting argument over the next several months, which of course will feature a lot of noise on television and the like. Simply follow price action is the best advice I can give as a fellow trader, due to the fact that price is truth, and everything else is nonsense. Ultimately, I think this is a market that will find its way higher, perhaps reaching towards the 4800 level but it is going to be a huge fight. The 4800 level has been resistive multiple times, so obviously if we can break above there it would be an extraordinarily bullish turn of events and could have this market looking towards the 5000 level over the longer term. It is not until we break down below the 4500 level that I would be concerned about the S&P 500, and even then the only thing I would do is buy puts because I do not short US indices.