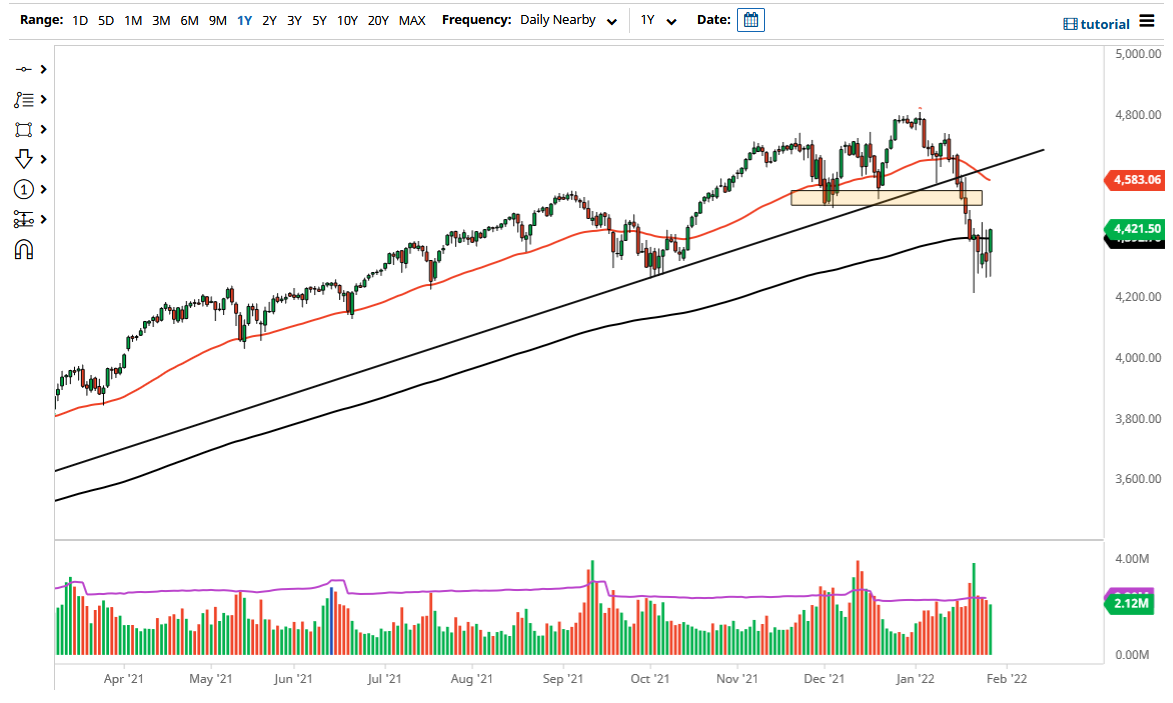

The S&P 500 initially fell on Friday, but it looks like we are trying to stabilize a bit near the 4250 level. That being said, we turned around to break above the 200 day EMA by the end of the session, as we continue to consolidate overall. I think at this point we are looking at consolidation with an attempt to try and rally from here, but the 4500 level will more than likely end up being a resistance barrier that will be tough to overcome. This has been made even more interesting by the fact that the 50 day EMA is starting to shrink and drop towards that level.

On the other hand, if we break down below the 4200 level, then the market is ready to drop towards the 4000 level. With quantitative easing ending in March, it is going to continue to be a big fear of traders around the world, and stock markets will be punished. This is especially true in the S&P 500 which has correlated almost perfectly with the Federal Reserve’s balance sheet. Ultimately, this is a market that has been fed on liquidity and not necessarily anything fundamentally meaningful over the last 13 years, and what we are seeing is the end of that. Whether or not we can continue to see some type of liquidity issue is more likely than not going to be the most important question.

When you look out into the future, the Federal Reserve will almost certainly recognize that it has made a mistake, although we have to worry about the inflationary pressures, as the market has to understand the fact that the Federal Reserve is painted into a corner, because real inflation in the real economy is something that Joe Biden has made a major issue about. That being said, we have already started to see a downward rate of change when it comes to inflation, so it makes sense that we would see the Federal Reserve going ahead and ignoring the stock market for the short term. However, as soon as we break down rather drastically, the Federal Reserve will more than likely come back to save their friends on Wall Street. That might be late in the year though.