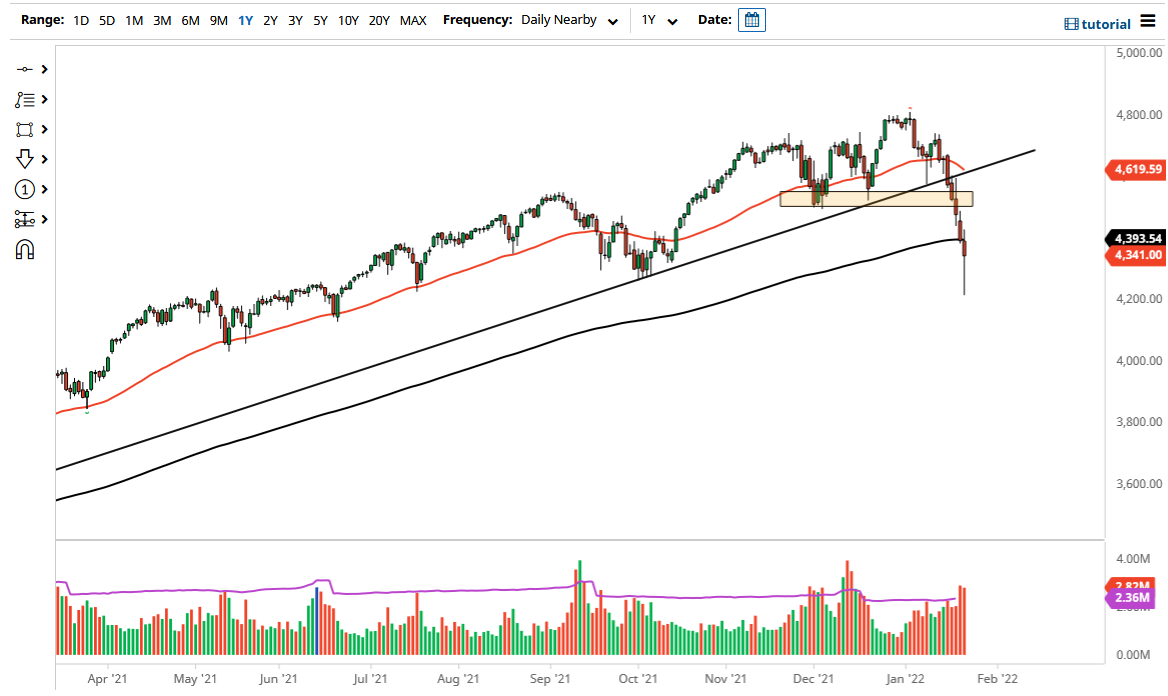

The S&P 500 sliced through the 200 day EMA on Monday, kicking off a fresh new wave of selling pressure. That being said, the market is likely to continue seeing noisy behavior as we head towards the FOMC meeting on Wednesday. That is going to be the most important thing to pay attention to this week, because the markets are going to be paying attention to whether or not the Federal Reserve will continue to flood the markets with liquidity.

Because of this, I suspect that the Federal Reserve meeting is part of what caused the bounce during the session. I do not think this is something that is sustainable until we have some type of idea as to what the Fed is going to do. After all, Jerome Powell has a long history of going back and forth with the markets, so it will be interesting to see whether or not he steps in to save everyone. The other thing to pay attention to will be inflationary concerns, but at this point it looks like the economy and inflation is essentially trying to slow down, so I suspect that given enough time the Federal Reserve is going to reverse course. I do not know that it is going to happen in the short term, but I do think that given enough time we will almost certainly see this happen.

Because of this, I think there may be a little bit of disappointment at the end of the day on Wednesday, and we will see more of a collapse. This will be the potential capitulation move, which is essentially what the market needs. It is likely that the market is going to retain its volatility, but we may have reached a bit of a peak for a while. With this being the case, I think that we may get a little bit of stability, followed by the next punch to the gut. I like the idea of fading rallies that show signs of exhaustion, unless Jerome Powell suddenly changes his term. I do not see that happening with inflation figures as high as they are, so I believe that before it is all said and done this week, we are going to see more disappointment.